Gold has outshone other reserve currencies such as the USD, JPY, EUR and CHF this year

Highlights

Gold has outshone other reserve currencies such as the USD, JPY, EUR and CHF this year. The surge of gold prices to new historical highs, which is accompanied by lower real US yields, looks impulsive and could have overshot in the near term. We would not be surprised to see some sort of tactical pull back.

But macro uncertainty, negative real interest rates, ample money supply and escalating tensions between the US and China should continue to attract strategic investment in gold. Risk of central banks attempting to inflate away a debt overhang in a world of near-zero interest rates and worries of currency debasement should keep gold as a “haven” asset of choice.

Renewed Covid-19 outbreaks restrict economic activity but also heighten expectations of further stimuli and debt build-up. This increases the risk that central banks could be tempted to inflate the debt burden away. Doing so would require that central banks signal higher tolerance for inflation and an ability to stop interest rates from following it upwards.

The September FOMC meeting could see the Fed signalling more monetary stimulus. There seems to be growing support among Fed officials to allow inflation to overshoot its 2% goal to signal that the Fed may not start lifting fed funds for up to the next five years. Investors seem willing to welcome a return to higher inflation down the road, as rising inflation expectations continue to drive US real yields further into negative levels.

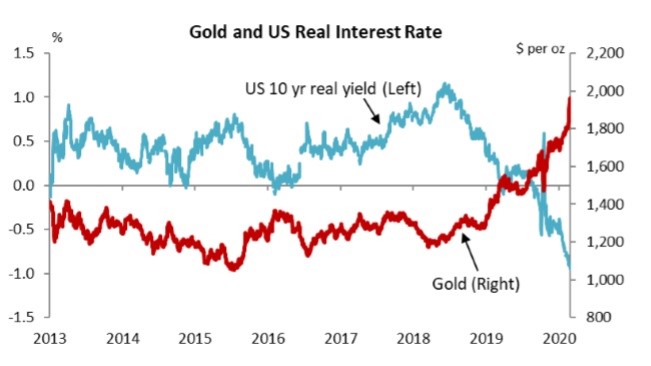

Gold is well supported by falling US real yields. This will limit corrections and keep gold as a “haven” asset of choice versus other traditional “safe assets” such as government bonds given that the benefits of declining nominal yields are mostly exhausted with interest rates already at virtually zero in the US and little indication that the Fed intends to drop them into negative territory.

Gold's rise goes hand-in-hand with the fall in US real yields

Source: Bloomberg, Bank of Singapore (data as at July 30,2020).

Gold’s rise is also an indication of currency debasement fears stoked by expansion of central bank balance sheets. Gold does not have the comparative negatives of other “haven” currencies such as the USD, JPY, EUR or CHF, as central banks can print money but cannot print gold.

Falling real US yields, as inflation expectations rise and nominal yields stay low, are becoming a significant challenge for the USD -- to the benefit of gold. Our view of a weaker USD should also help boost the purchasing power of major emerging market (EM) gold consumers such as China and India. This suggests that EM demand could shift from being a headwind to tailwind for gold prices. The EU recovery fund may enhance the EUR’s safe haven status, but negative yields still put EUR at a disadvantage to gold.

It is tough to gauge whether the trend (of higher gold prices) is still your friend. We would be comfortable in calling an imminent top in gold if there is availability of a vaccine soon or Covid-19 miraculously burns itself out to pave way for a return of V-shaped recovery expectations. Sound bites are positive on the Covid-19 vaccine but the availability of one soon is more a hope than a reality for now. We think gold prices are biased to stay higher for longer. A range between USD 20002200/oz is likely before the market begins to anticipate Fed tightening.

As for silver, it should continue to play catch-up to gold. Silver should gain from better prospects for silver industrial demand, particularly in solar energy and in consumer electronics that is benefiting from the transition to working from home. The bargain hunting in silver should be seen in the context that silver prices remain historically depressed relative to gold, although that is starting to correct with the gold/silver ratio plunging to 80x from a tight range between 95x to 100x in June. Assuming that gold/silver ratio grinds down to the mid-70x area, silver prices could settle into a new higher range of USD26-USD29/oz in 6-12 months’ time. That said, be mindful that silver is much more volatile, speculative and largely driven by retail rather than institutional interests.

At 80x, gold/silver ratio is still at historically high levels...

Source: Bloomberg, Bank of Singapore (data as at July 30,2020)

This article was first published by Bank of Singapore on July 30, 2020. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.