This week officials have been out in force reiterating the Federal Reserve’s dovish view

HighlightsThis week officials have been out in force reiterating the Federal Reserve’s dovish view that inflation rises this year will only be temporary as the economy reopens from the pandemic.

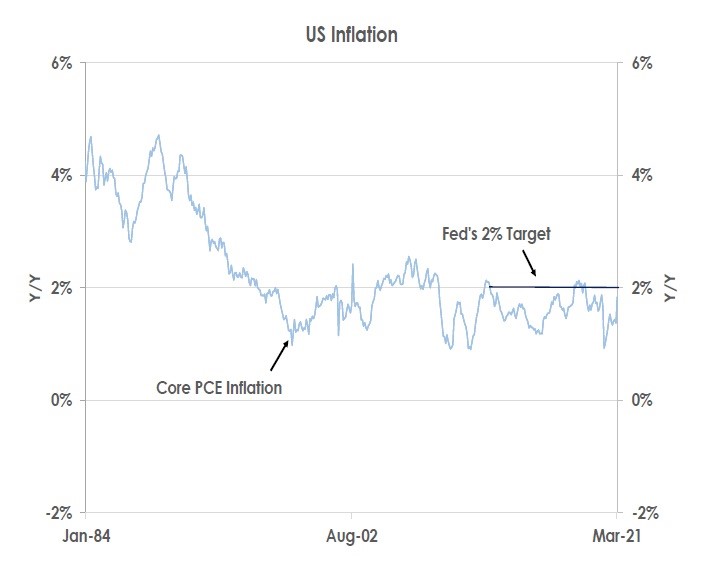

The chart shows the Fed’s target measure of inflation - changes in core personal consumption expenditure (PCE) prices - has started to pick up as the economy rebounds. In March core PCE inflation increased from 1.4%YoY to 1.8%YoY.

Policymakers expect inflation will rise above the Fed’s 2% target in April and May as changes in consumer prices are compared to the very weak inflation readings at the start of the pandemic a year ago. We believe such ‘base effects’ as well as supply chain disruptions from firms trying to raise output quickly to meet surging demand from the reopening are set to increase core inflation to 2.5%YoY in the next couple of months.

But Fed officials note inflation above 2% this year will not be sustained as unemployment remains high. Thus, Vice Chairman Clarida said: ‘we’re still a long way away from our goals … we don’t see [the economy] overheating as a baseline. Our baseline view is that inflation is going to be close to our long-run objective of 2%.’

Similarly, New York Fed President Williams said: ‘my expectation is that once the price reversals and short-run imbalances from the economy reopening have played out, inflation will come back down to about 2% next year.’

Source: Bank of Singapore, Bloomberg

Source: Bank of Singapore, Bloomberg

The Fed’s lack of urgency to begin tapering its quantitative easing or to raise its fed funds interest rate from 0.00-0.25% despite inflationary pressures was underscored by Chairman Powell who warned: ‘we are not out of the woods yet.’

The central bank’s calmness isn’t surprising. Under its new strategy of seeking inflation to average 2%, the Fed can let inflation overshoot its 2% goal without reacting if it considers above-target inflation rates to be temporary. Thus, officials can keep the current strong pace of quantitative easing unchanged while focusing on securing the US recovery from the pandemic.

Before the central bank tapers its quantitative easing, officials want the economy to make ‘substantial further progress’ towards the Fed’s goals of full employment and average 2% inflation. Thus, the unemployment rate needs to fall further to its pre-pandemic level of 3.5% from 6.0% at present. In addition, this week Richmond Fed President Barkin said a rise in America’s employment-to-population ratio from its current depressed level of 57.8% back to its pre-virus rate of 61.1% would represent the ‘substantial further progress’ needed for the Fed to start tapering.

In short, the central bank seems more intent on strengthening the labour market rather than worrying about near-term inflation risks. We thus expect the Fed will only start tapering its quantitative easing in early 2022 and will not raise its fed funds interest rate until as late as 2024.

This article was first published by Bank of Singapore on May 7, 2021. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.