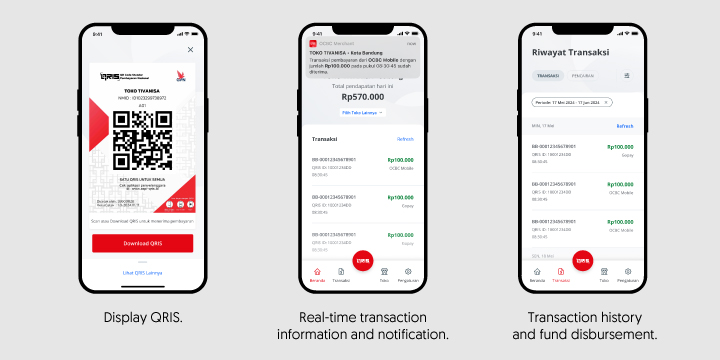

Fast and secure payment acceptance

Real-time transaction information at your fingertips

Transparent and organized financial management

Main features:

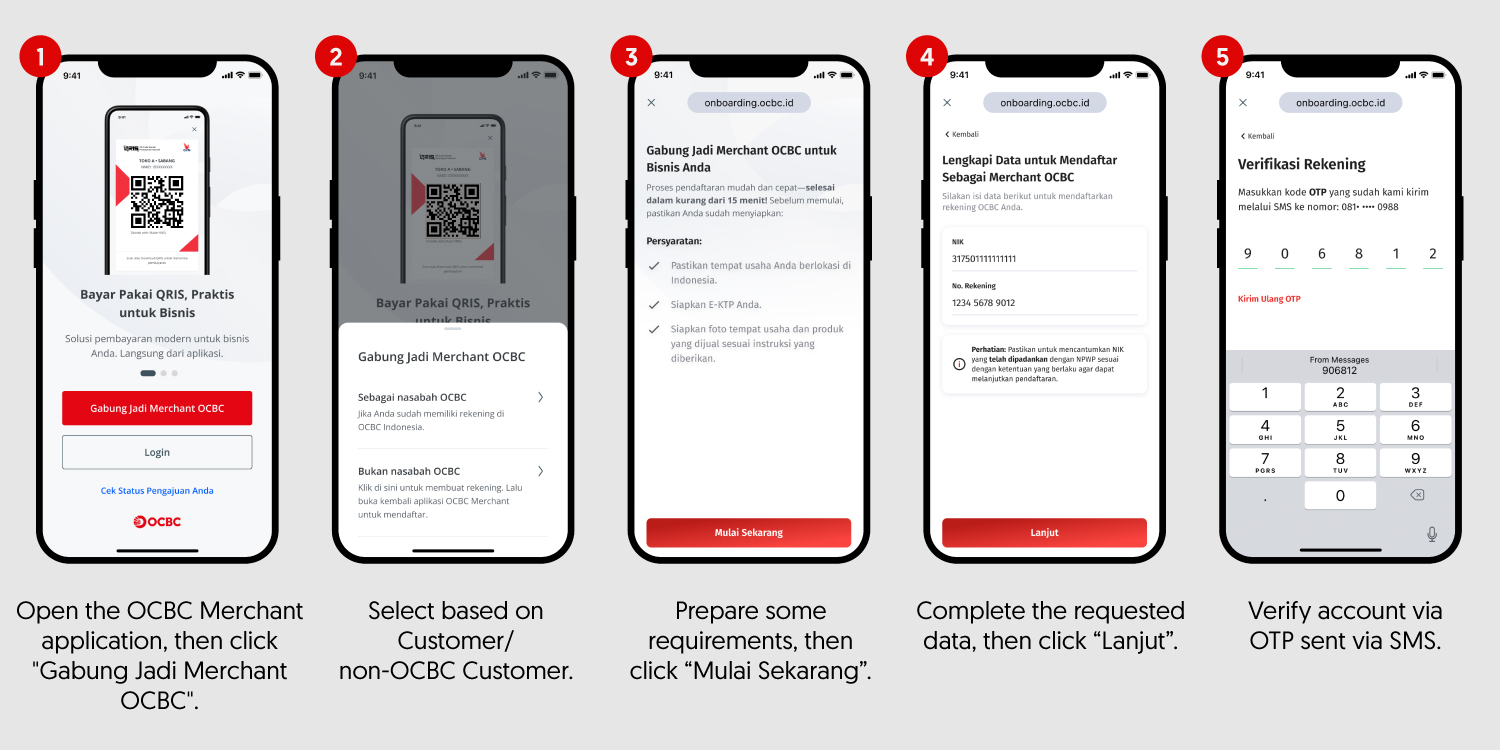

As an OCBC Customer

As a Non OCBC Customer

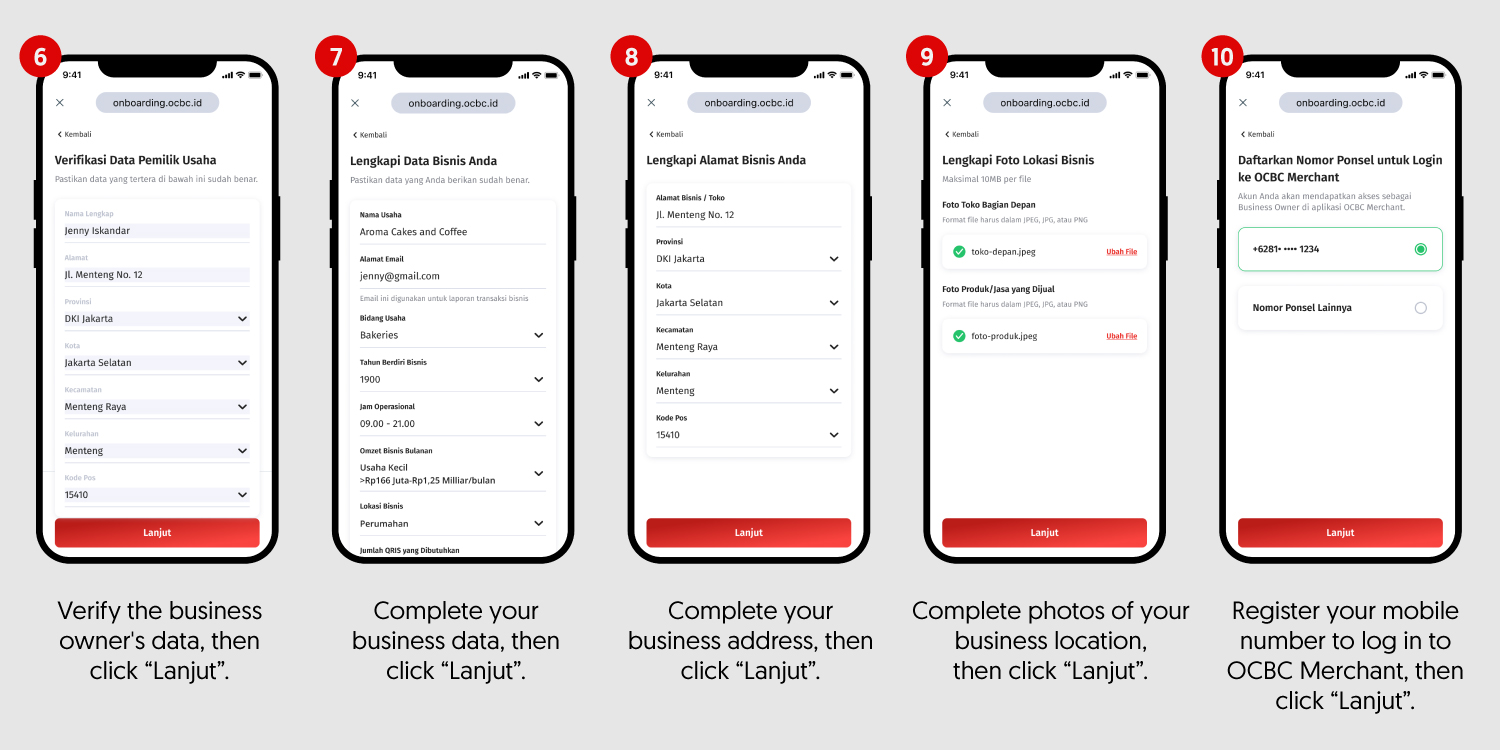

Guide to fill registration form:

| Document Requirements | LLC | CV | Foundation | Personal |

|---|---|---|---|---|

| Merchant Terms and Conditions | If there are special agreement, MCC applies | ✓ | ||

| Identity of the owner or person in charge | ✓ On behalf of the director | ✓ On behalf of administrators | ✓ | |

| Taxpayer Identification Number | ✓ | ✓ On behalf of a person | ||

| Registration certificate (TDP) or business registration number (NIB) | ✓ | ✓ | ✓ | ✓ |

| Business License (in the form of a business permit or equivalent document) | ✓ | ✓ | ✓ | - |

| *For Offline Merchants: Location photos (front, left, and right view), photos of goods & business activities and sales, and photos of signage. *For Online Merchants: Website display photos and business location photos (warehouse & office) |

✓ | ✓ | ✓ | ✓ |

| Deed of incorporation or amendment | ✓ | ✓ | ✓ | - |

| Decree of the Ministry of Law and Human Rights | ✓ | - | ✓ | - |

Notes:

| Solution | Merchant Category | MDR |

|---|---|---|

| QRIS | Micro with transaction amount ≤Rp500.000 | 0% |

| Micro with transaction amount >Rp500.000 | 0.3% | |

| Regular | 0.7% | |

| Education | 0.6% | |

| Gas Station | 0.4% | |

| Social assistance/donations (mandatory on behalf of Foundations/Social Organizations) | 0% |

*MDR is calculated from the nominal amount of transactions processed

Email: merchant_solutions@ocbc.id.

Call: 1500-999

OCBC Merchant is a digital service platform owned by PT Bank OCBC NISP Tbk ("OCBC") that can be used by merchants who are OCBC customers in monitoring the receipt of QRIS transaction payments for their businesses and other matters related to OCBC QRIS.

OCBC Merchant has the following services:

Merchant is an OCBC customer who has registered as a merchant in the OCBC Merchant Solution service.

The daily transaction report will be sent to the email registered on the Merchant Application Form in excel format (.csv).

You can register as a merchant by:

For individual customers, prepare your ID card (KTP), tax identification number (NPWP), a front view photo of your business (showing right and left), and a photo of your products.

Ensure that the registered NIK has been integrated with NPWP, and make sure that the phone number used to register for OCBC Merchant is the same as the phone number you used when opening your OCBC account, as OCBC will verify the data using the phone number registered in the Bank's system.

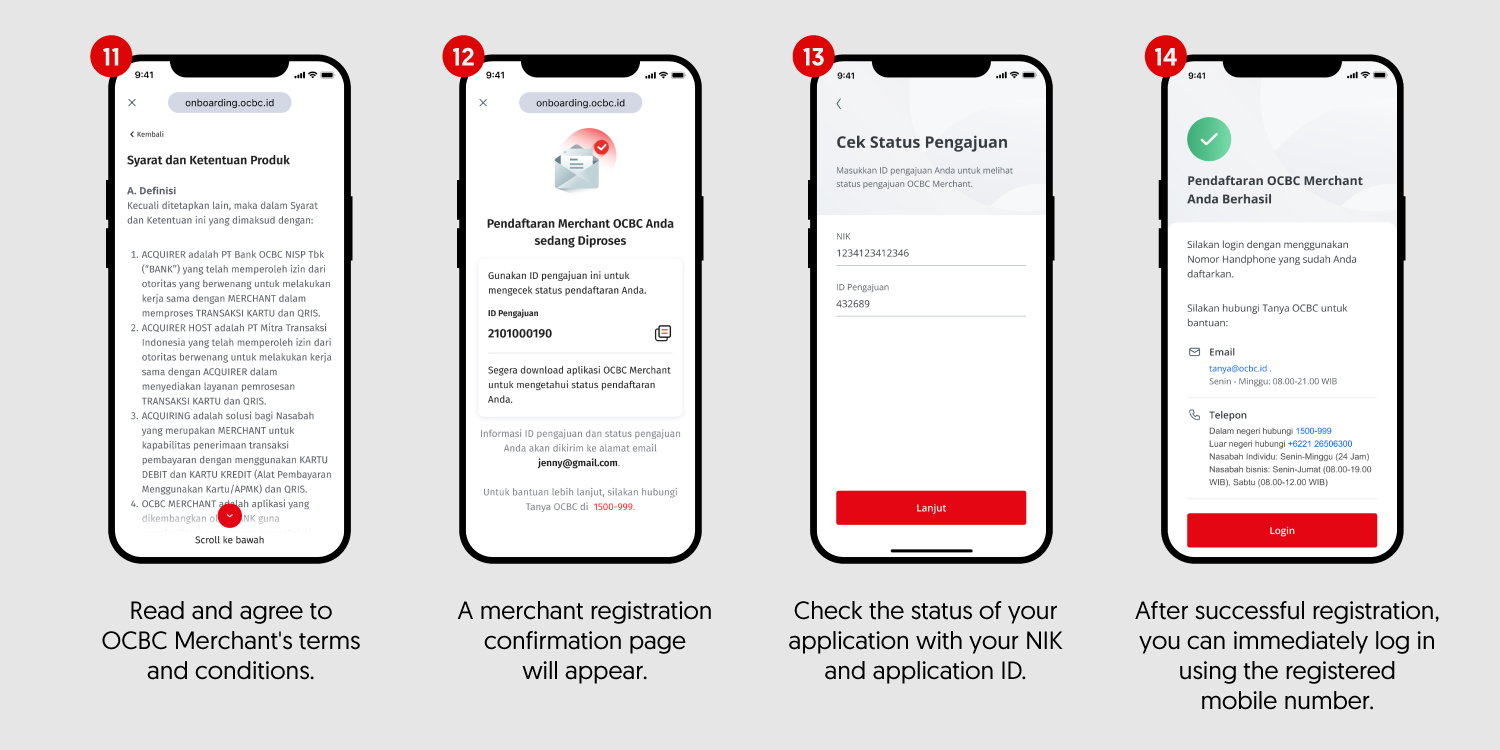

Once you have completed the registration, OCBC Merchant will provide an Application ID through the application and email. You can check the application status in the OCBC Merchant app by entering the Application ID and NIK used during registration.

You can contact Tanya OCBC at 1500-999 / 021-2650-6300 (from overseas) or email to tanya@ocbc.id.

Currently, the OCBC Merchant digital registration form can only be used by individual customers who have Nyala Individual account and Nyala Bisnis Individual account (Current Account). Meanwhile, Business Entity customers can register by visiting the nearest branch.

You can contact Tanya OCBC at 1500-999 / 021-2650-6300 (from overseas) or email tanya@ocbc.id or through OCBC Mobile app, to update your data. After successfully updating your data, please re-register as a merchant.

The processing time for the registration until approval is 3 working days.

After the prospective merchant has completed the registration in the application, the Application ID will be provided through the application and email. The prospective merchant can check the registration status through the application using that Application ID. The prospective merchant will also receive notification via SMS and email once the registration has been approved.

Merchant can log in using the phone number that has been registered on the Merchant Application Form along with the password that has been previously created.

Devices with a minimum operating system of Android 5 or iOS 15.0.

Only business owner account can add employee's and store cashier's phone numbers as new users to be granted certain access by:

In the settings menu, you can change your password, view FAQs, terms and conditions, and contact Tanya OCBC.

Yes, as a business owner, you can access and use OCBC Merchant for several registered businesses with the same phone number.

Currently, the use of 1 phone number in the OCBC Merchant application can only be used for 1 role. So, make sure the phone number you use is different for each role!

Yes, you can add store employees or cashiers as new users and there is no maximum number as long as each registered phone number is different.

Yes, you can designate one employee in your business to gain access rights as a business owner in the application.

After logging in, click the red button with the text "QRIS" in the bottom center.

You can receive payments via QRIS, which can be accessed through the red button with the word "QRIS" at the bottom center, and show it to the customer so it can be used / scanned by entering the transaction amount.

When the payment is received, payment information can be seen on the homepage, transaction page, and push notifications. The homepage displays real-time transaction history for the day, while the transaction page allows filtering according to the desired date.

For the merchant refund process, you can contact merchantcare@ocbc.id or call Tanya OCBC at 1500-999 / 021-2650-6300 (from overseas).

You can contact Tanya OCBC at 1500-999 / 021-2650-6300 (from overseas) or email to tanya@ocbc.id or through the OCBC mobile app to update your data first. After successfully updating your data, please try again to register as a merchant.

Funds will be received by the merchant on the next working day (D+1) in total and have already been deducted for MDR (transaction fees).

You will receive 3 notifications:

You can contact merchantcare@ocbc.id or call Tanya OCBC at 1500-999 / 021-2650-6300 (from overseas).