Especially for you, invited OCBC Customers, get the chance to get up to 5,400 Poinseru/month just by reactivating your old account, do transactions, & open products with following terms & conditions:

6x transactions accumulation of Rp500.000,- with the obligation to make combination of transactions, with a minimum 1x transaction for each payment activity as follows:

|

Get 1.250 Poinseru/Month Valid for customers Nyala Fit until Nyala Pro. |

| Get 2.500 Poinseru/Month Valid for customers Nyala Master or Premier |

*The program period valid 1 January – 31 August 2025

| Average Daily Balance 1 month min.IDR 1 million Multiples apply | Min. 50 Poinseru/Month/Customer min. 600 Poinseru/Year/Customer |

| Max. 2,500 Poinseru/Month/Customer max 30,000 Poinseru/Year/Customer |

Valid for 360 (Community) Marks, 360 Plus Marks (Digital, Community, Private Banking, ON Employees), and ON Employee Marks with Rupiah currency that are non-hold.

| Monthly Deposit

min. IDR 100 thousand with min.

tenor/target time 12 months

Multiples apply The following is a list of TAKA products that get Poinseru:

|

Min. 40 Poinseru/Month/Customer min. 480 Poinseru/Year/Customer |

| Max. 400 Poinseru/Month/Customer max 4,800 Poinseru/Year/Customer |

No need to worry should your OCBC debit Card or contact details have been changed/lost. You can still reactivate your old account quickly & easily via OCBC mobile!

You can check the complete guide here

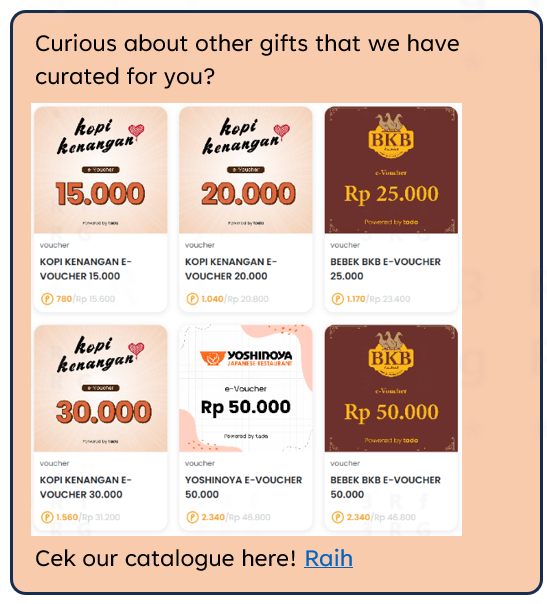

Cek our catalogue here! Raih

Further information, kindly contact TANYA OCBC via phone 1500-999 or WhatsApp 0812-1500-999