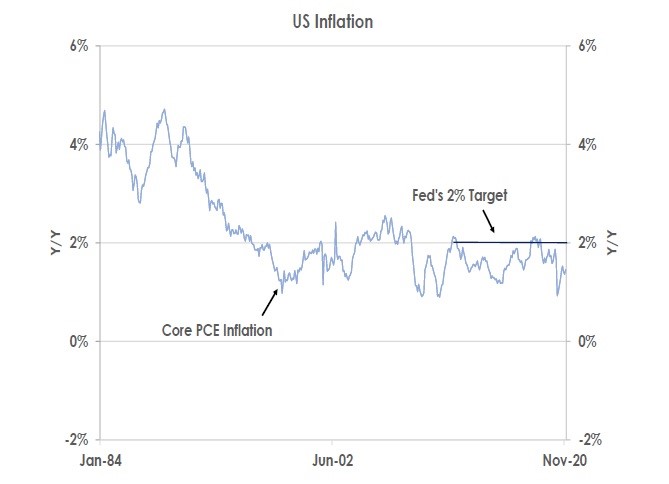

In the major economies, inflation remains low as winter virus waves continue to restrain activity. The Federal Reserve’s target measure of inflation - changes in core personal consumption expenditure prices (PCE) - is currently well below the central bank’s 2% goal at 1.5%.

In the major economies, inflation remains low as winter virus waves continue to restrain activity.

Source: Bank of Singapore, Bloomberg

The Federal Reserve’s target measure of inflation - changes in core personal consumption expenditure prices (PCE) - is currently well below the central bank’s 2% goal at 1.5% as the first chart shows. Similarly, Eurozone and UK core inflation were running at 1.4% in January while in China, core inflation printed below zero at -0.3% last month.

But in the next few months, financial markets may suffer an ‘inflation scare’ when the sharp falls in consumer prices seen at the start of the pandemic in March and April last year are no longer included in year-on-year inflation rates this year.

Source: Bank of Singapore, Bloomberg

Such ‘base effects’ are likely to see US core inflation jump from 1.5% up to the Fed’s 2% target or even higher over the next few months. Financial markets are already becoming more wary of inflation as the global economy recovers from the pandemic. The chart above shows that oil prices are now at a one-year high of USD63 a barrel and copper prices are at an eight-year high of USD8,400 a tonne.

Source: Bank of Singapore, Bloomberg

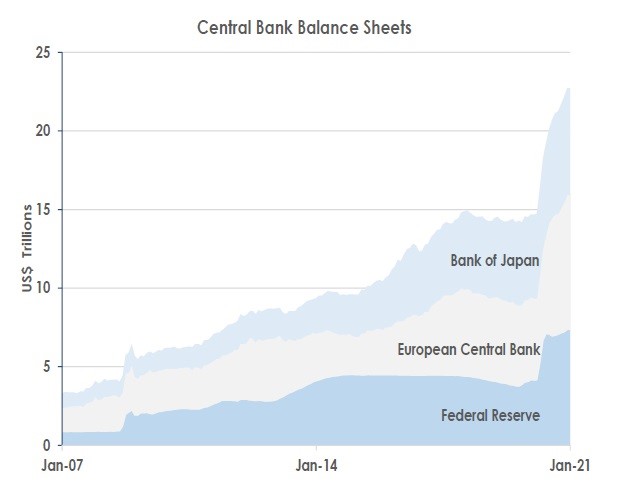

Inflationary fears are also rising because of the massive liquidity central banks are providing through quantitative easing during the pandemic. The chart above shows, the Fed’s, the European Central Bank’s and the Bank of Japan’s balance sheets have soared through printing record amounts of money to buy bonds.

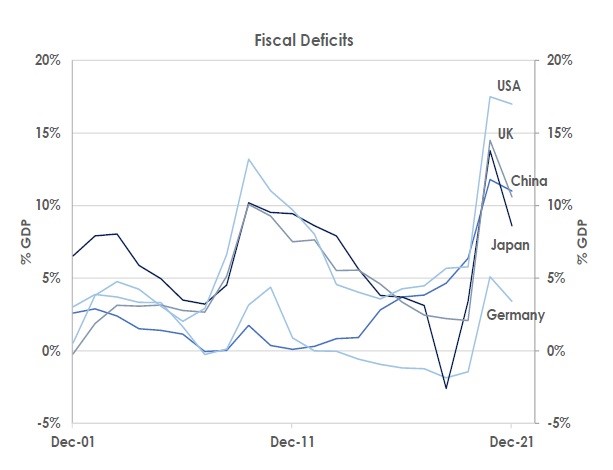

At the same time, the huge fiscal deficits governments are running to support their economies during the pandemic is also fuelling fears that inflation will rise well beyond central banks’ 2% targets.

Source: Bank of Singapore, Bloomberg

For example, if the Biden administration’s USD1.9 trillion fiscal stimulus plan is passed in full by Congress then the US government budget deficit could again be over 17% of GDP in 2021, for the second year in a row as the chart above shows.

Source: Bank of Singapore, Bloomberg

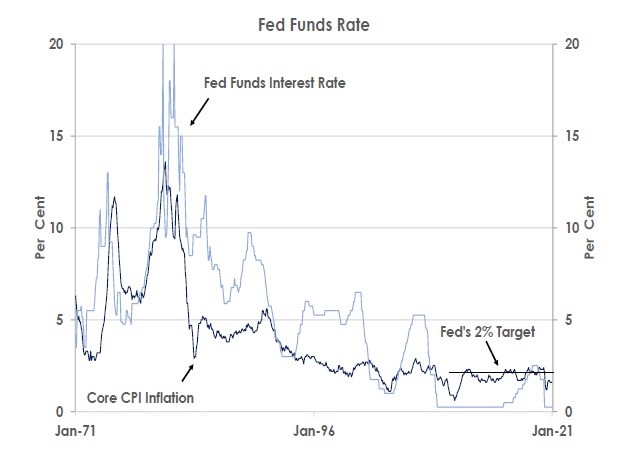

Last, the Fed’s recent shift to ‘average inflation targeting’ is also making some investors nervous. The chart above shows inflation has been largely below the central bank’s 2% goal for the last decade. Thus, to ‘make up’ for prior shortfalls and allow inflation to average 2% in future, the Fed is now prepared to let inflation moderately exceed its 2% target for up to a full year before it would consider raising interest rates. The new strategy, however, is raising concerns that the Fed may lose control of inflation - if consumer price rises keep escalating significantly beyond the central bank’s 2% target before the Fed starts lifting fed funds from 0.00-0.25%.

Source: Bank of Singapore, Bloomberg

In short, upcoming ‘base effects’, higher commodity prices, massive quantitative easing, record government budget deficits and the Fed’s new average inflation targeting strategy are all increasing fears that inflation will rise sharply. Thus, long-term US Treasury yields are rebounding and the bond curve is steepening. The chart above shows 10Y Treasury yields are now trading at 1.24% - up from 0.90% at the start of 2021 - and 30Y yields are back above 2.00%

But crucially for risk assets, the Fed’s credibility is stopping Treasury yields rising faster as financial markets expect the central bank will not taper its bond buying (quantitative easing) this year or lift its fed funds rate for another couple of years.

Source: Bank of Singapore, Bloomberg

The Fed has strong arguments for expecting any rise in inflation this year above its 2% target on the back of ‘base effects’ will only prove temporary and inflation will subsequently fall back below its 2% goal. Thus, the central bank does not forecast raising its fed funds rate until at least 2024 (similar to our own view of no Fed hikes until 2024 or 2025). The chart above shows US unemployment at 6.3% is still far above its pre-pandemic rate of 3.5% while non-farm payrolls are still 10 million jobs lower than before the outbreak of the virus. The weakness of the labour market is therefore likely to stop wages rising sharply, keeping a lid on inflationary pressures even as the US recovers.

Source: Bank of Singapore, Bloomberg

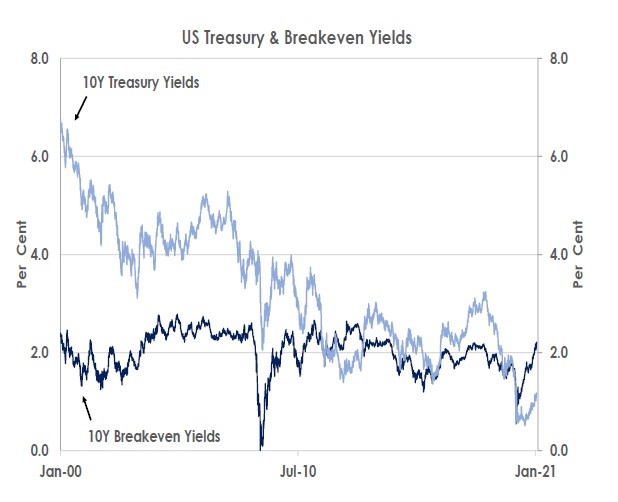

We believe the Fed is right to see increases in inflation this year as being only temporary - rather than requiring interest rates to be hiked to stop inflation escalating out of control. Inflation expectations are rising. The chart above shows 10Y breakeven rates - the difference between 10Y Treasury yields and 10Y Treasury Inflation-Protected Securities (TIPS) - are now above 2.20%. But 10Y Treasury yields are still trading around historically low levels because of expectations the Fed will stay dovish.

Source: Bank of Singapore, Bloomberg

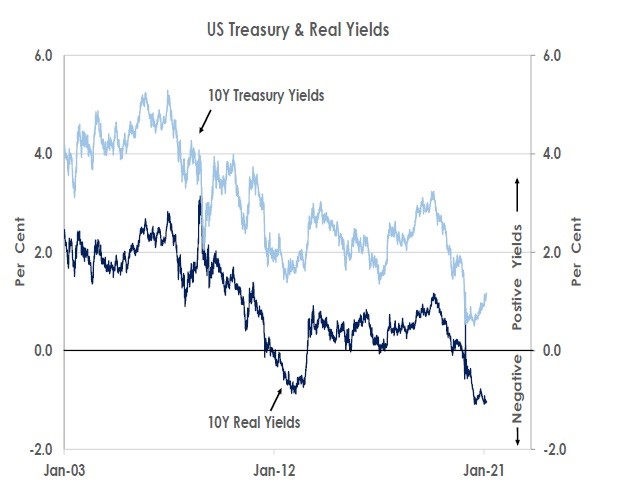

Thus, 10Y real US interest rates - the difference between 10Y Treasury yields and 10Y breakeven rates (inflation expectations) - continue to be deeply negative near -1.00%, as they have since the pandemic began as the chart above shows.

Negative real interest rates support risk assets, for example, by reducing borrowing costs for corporates and by lowering the opportunity cost of holding commodities.

Source: Bank of Singapore, Bloomberg

The charts above and below show how the S&P 500 and gold prices have been boosted by real US interest rates falling below zero over the past year.

Source: Bank of Singapore, Bloomberg

Thus, we think investors should not fear any ‘inflation scare’ caused by ‘base effects’ pushing inflation rates up over the next few months. Instead, we expect the Fed to stay dovish and ‘look through’ temporary overshoots in inflationabove its 2% goal. Unemployment is likely to keep inflation from escalating out of control, enabling the Fed to leave fed funds at 0.00-0.25% until as late as 2024 or 2025.We therefore do not see rises in inflation this year causing a broader shock that hurts financial markets by sharply increasing bond yields. We expect 10Y Treasury yields will steepen further in 2021 but only to 1.50% - a still historically low level that will keep benefiting risk assets.

This article was first published by Bank of Singapore on February 17, 2021. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.