| Jaringan ATM | Biaya Tarik Tunai (Rp) |

|---|---|

| Bersama/Prima | 8.000 |

| OCBC Bank Singapura | 10.000 |

| Bank Card Malaysia | 15.000 |

For rates and other fees, click here

You can reset your OCBC Internet Banking Password via:

You can reset your OCBC Internet Banking Password via:

Beyond Banking facilities include:

Beyond Banking facilities will be made available to Premier Banking customers who have fulfilled the applicable terms and conditions.

Customers can enjoy Beyond Banking facilities from the Beyond Banking Package chosen as prederred.

Available package options include:

The usage eligibility refers to the average combined monthly balance for the last 3 (three) consecutive months with a minimum of IDR 1 billion per month

The monthly quota is updated on the 3rd (three) day of every month and is valid until 2nd (second) day of the following month. Example: March quota is on 3rd March – 2nd April

The Service Level Agreement (SLA) for each facility requests is H-2 business days. For example, a request for usage on Monday must be submitted by the end of the day on Thursday.

For individual customers, the facility applies to the account holder. For joint accounts (AND or OR), the facility applies to the first name listed on the account.

Customers can select a package when they join the Premier Banking service.

Customers can contact their Premier Banking Manager (PBM) to register for the package through the available channels provided.

Customers can start using the facility after fulfilling the eligibility criteria, based on the average combined balance for the past three consecutive months.

The Beyond Banking package is valid for one (1) calendar year. Customers may apply for the changes when the changes period is opened.

Example: If a Customer joins the Premier Banking service and selects the Signature package in May 2024, the package is valid until December 2024. Customer is allowed to change their January to December 2025 Beyond Banking Package during the change period in November 2024

Yes, the package can be changed. The change request can only be done during the change period that the Bank will announce through the Bank’s official channels. Customers need to ensure that their personal mobile phone numbers and email address are updated and valid in the Bank’s system.

If a Customer has not selected a Beyond Banking package, they will not be able to request Beyond Banking facilities.

The type of vehicle is predetermined, with Premium SUVs subject to vendor availability. Examples of Premium SUVs include Alphard, Voxy, Vellfire, etc.

Domestic Vendors:

Singapore Vendors:

| Kota | Bandara/ Stasiun |

|---|---|

| Jakarta | Soekarno Hatta |

| Surabaya | Juanda |

| Denpasar | I Gusti Ngurah Rai |

| Medan | Kualanamu |

| Yogyakarta | Adi Sutjipto & YIA |

| Makassar | Hasanudin |

| Malang | Abdul Rahman Saleh |

| Padalarang | Kereta Cepat Whoosh |

The facility is available at Changi Airport and Harbour Front.

Domestic Pick-Up Services:

Pick-Up Services in Singapore:

LI-NK and Strides Vendors:

Confirmation will be sent by the Bank no later than H-1 business day before the facility usage date to the customer's email address and SMS, based on the data recorded in the bank's system.

The bank covers the basic rates for pick-up and drop-off services, excluding waiting services beyond the SLA and additional routes.

Booking can be made by contacting your assisting Premier Banking Manager (PBM).

or

For booking Pick-Up Services facilities, customers can independently use the OCBC mobile application with complete guidance available at the following link: https://web.ocbc.id/pus-mobile

Medical Check Up is available in Indonesia and Singapore.

Indonesia Vendors:

Singapura Vendors:

Medical Check Up Indonesia serves examinations at laboratories/home service, while for Medical Check Up Singapore, only serve examinations at hospitals.

Some of the things that must be prepared are:

Confirmation will be sent by the Bank no later than D-1 working day from the date of use of the facility to the Customer's email address and SMS according to the data recorded in the Bank's system.

The bank only covers the examination fees listed in the table above.

Ordering Medical Check Up Indonesia facilities can be done independently on the OCBC mobile application with complete instructions on the link web.ocbc.id/beyondbanking.

Or

Booking can be made by contacting your assisting Premier Banking Manager (PBM).

There are several conditions:

| Currently in effect | In effect per 3 July 2024 |

|---|---|

| If the Nyala Customer fails to meet the average combined balance requirement above Rp1,000,000 in the last month, a service fee of Rp10,000 will be charged on the 3rd of the following month. In the event that the Customer's funds in the account are insufficient to debit the service fee, it will become arrears charged to the Customer in the following month. If the Nyala Customer fails to meet the average combined balance requirement above Rp1,000,000 in the last month, a service fee of Rp10,000 will be charged on the 3rd of the following month. |

In the event that the Customer's funds are insufficient for service fee debiting, one of the following two (2) debiting methods will be applied:

|

For more information, please contact TANYA OCBC at 1500-999/ +62-21-26506300 (overseas).

NYALA is a service from Bank OCBC that will give you financial solutions to grow money and provide various benefits so you can be #FinanciallyFIT.

Per September 1, 2022, the Nyala service will have four benefit tiers based on the Average Combined Balance: BASIC, FIT, PRO and MASTER.

More information regarding benefits of Nyala check here.

The Combined Balance calculates all products (including Sharia products) owned by the Customer in the form of savings, time savings, current accounts, time deposits, and Wealth Management products such as Bonds, Mutual Funds, Foreign Exchange and Bancassurance (using market indication value or investment cash value).

The Average Combined Balance (per month) is calculated by adding up balances on all products at the end of each day, then at the end of the month divided by the number of days in the month. Calculations are made from the 1st (one) day to the end of the month (28 / 29 / 30 / 31).

More information can be accesed here

To join the NYALA service, you must be an OCBC Customer and have at least 1 (one) savings product from OCBC.

Example A:

You are an OCBC Customer and activated Nyala for the first time on September 1, 2022. You will receive the MASTER benefits in the first month regardless of your Combined Balance. The following month, on October 3, 2022, the Bank will review whether you stay, increase or decrease the level based on your September 2022 Average Combined Balance. During the next month (October 3 – November 2 2022), you can enjoy the benefits level according to your Average Combined Balance.

Example B:

You are an OCBC customer who activated Nyala Digital or Nyala Individual before September 1, 2022. On September 1, 2022, your Nyala benefit level will be automatically updated according to the Nyala benefit provisions in point (2) above. You will enjoy the MASTER level benefits in the first month as a welcome reward. The following month, on October 3, 2022, the Bank will review whether you stay, increase or decrease the level based on your September 2022 Average Combined Balance. During the next month (October 3 – November 2 2022), you can enjoy the benefits level according to your Average Combined Balance.

The Young Nyala Debit Card (previously known as Mighty Savers) is a debit card linked to Tanda Junior account, designed for customers under the age of 17. The Young Nyala Debit Card can be used for transactions at EDC terminals with DIP IN or TAP, as well as for cash withdrawals from the IDR account.

The Young Nyala Debit Card allows for daily spending and cash withdrawals totalling up to IDR 1.000.000 (one million rupiah).

Effective August 16, 2024, Young Nyala Debit Cardholders can enjoy transactions up to IDR 1.000.000 per day through OCBC mobile.

If the debit card linked to a Tanda Junior account with the following 9-digit card numbers:

There are several designs for the debit card as follows:

Marked by the “debit” logo and the contactless logo on the right side of the front face card.

No monthly admin fee for Young Nyala Debit Card.

Parents can request a new design card at the nearest OCBC branch.

Fees are subject to the current rates and charges.

The Young Nyala Debit Card can be used for both shopping and cash withdrawals abroad through the Mastercard network, with conversion and debiting from the IDR account.

The Young Nyala Debit Card can be used for online shopping transactions. Ensure online transactions are activated through the parent’s OCBC mobile account by:

Yes, no fee is only valid in IDR

| Features & Benefits | Tanda Valas SGD | Tanda 360 Plus |

|---|---|---|

| Withdrawal at ATM OCBC Indonesia and OCBC Singapore | Yes | Yes |

| Withdrawal or transfer (including Telegraphic Transfer) via branch and OCBC mobile | Yes | Yes |

| Withdrawal at ATM with Mastercard logo all over the world | No | Yes |

| Shop online and offline via Mastercard EDCs by tap or dip-in your Global Debit like locals | No | Yes |

| Shop and withdraw cash directly debit Tanda 360 Plus Account without conversion and with no fee | No | Yes |

| Promotions for online transaction with Global Debit such as Grab, Tokopedia and Shopee (https://www.ocbc.id/id/promo) | No | Yes |

The CCV number is no longer visible on the back of the Nyala Platinum credit card. The CVV number can be seen on the OCBC mobile Application. With the following steps:

| Terms | OCBC Titanium Credit Card |

|---|---|

| Age | Main Card Holders aged 21 - 65 years Additional Card Holders for a minimum of 17 years (Maximum 3 people |

| Citizenship | Indonesian citizen and foreign national |

| Income | Min Income: Rp. 60,000,000 per year. |

| Personal Identification Documents | Photocopy of KTP or Photocopy of Passport / KIMS / KITAS (For foreigners only) or Photocopy of Other Bank Credit Cards (For Other Bank Customers) |

| Income Document | Original month's latest salary slip / Statement of Income (Especially Employees and Foreigners) or Photocopy of SIUP / Company Establishment Deed Current account / savings account for the last 3 months (only for entrepreneurs) or Current Account / Savings Account for the last 3 months, Photocopy of Practice Permit and Photocopy of SPT (Professional Only). |

The reason you are not eligible to receive cashback rewards is because you do not meet the terms and conditions of the cashback rewards program or your Credit Card is blocked. Bank in accordance with the bank's policy and/or analysis also can refuse to provide or withdraw cashback if there is an indication of fraud committed in the use of this program. If you have met the terms and conditions but have not received cashback, please contact Tanya OCBC 1500-999.

Installment application via OCBC mobile

OCBC mobile Application *

Download the latest version of the OCBC mobile Application and follow these steps:

(* Create PIN via OCBC mobile only for Primary Card holders)"

The fee charged for the installment application is IDR15,000 per application

| Terms | OCBC Platinum Credit Card |

|---|---|

| Age | Main Card Holders aged 21 - 65 years Additional Card Holders for a minimum of 17 years (Maximum 3 people |

| Citizenship | Indonesian citizen and foreign national |

| Income | Min Income: Rp. 120,000,000 per year. |

| Personal Identification Documents | Photocopy of KTP or Photocopy of Passport / KIMS / KITAS (For foreigners only) or Photocopy of Other Bank Credit Cards (For Other Bank Customers) |

| Income Document | Original month's latest salary slip / Statement of Income (Especially Employees and Foreigners) or Photocopy of SIUP / Company Establishment Deed Current account / savings account for the last 3 months (only for entrepreneurs) or Current Account / Savings Account for the last 3 months, Photocopy of Practice Permit and Photocopy of SPT (Professional Only). |

Terms and Conditions for Exchange of OCBC Platinum Credit Card Reward Points through www.poinseru.com:

Points redemption for prizes are made directly through www.poinseru.com. Here are the steps to exchange your points:

For more information about the question and answer exchange question, please visit https://www.poinseru.com/#!/redeem-point

OCBC mobile Application *

Download the latest version of the OCBC mobile Application and follow these steps:

(* Create PIN via OCBC mobile only for Primary Card holders)"

| Terms | OCBC 90°N Credit Card |

|---|---|

| Age | Main Card Holders aged 21 - 65 years Additional Card Holders for a minimum of 17 years (Maximum 3 people |

| Citizenship | Indonesian citizen and foreign national |

| Income | Min Income: IDR 120,000,000 per year. |

| Personal Identification Documents | Photocopy of KTP or Photocopy of Passport / KIMS / KITAS (For foreigners only) or Photocopy of Other Bank Credit Cards (For Other Bank Customers) |

| Income Document | Original month's latest salary slip / Statement of Income (Especially Employees and Foreigners) or Photocopy of SIUP / Company Establishment Deed Current account / savings account for the last 3 months (only for entrepreneurs) or Current Account / Savings Account for the last 3 months, Photocopy of Practice Permit and Photocopy of SPT (Professional Only) or Photocopy NPWP. |

Redeem your Travel Miles through Raih.id which can be accessed via a browser or the OCBC mobile application.

Collect Miles from Favorite Airlines or Exchange Whatever Your Travel Needs with OCBC 90°N Credit Card

OCBC mobile Application *

Download the latest version of the OCBC mobile Application and follow these steps:

(* Create PIN via OCBC mobile only for Primary Card holders)

Travel Miles Bonus

*Enjoy an Activation Bonus of 13,000 (Thirteen Thousand) Travel Miles

** Enjoy 1,000 (one thousand) Travel Miles monthly Bonus

Collect Travel Miles Faster

| Travel Miles EarningTM | |

|---|---|

| Every Domestic Transactions IDR10,000 = 1 Travel Miles | 4.000 |

| Bonus Travel Miles | 13.000 |

| Total Travel Miles | 17.000 |

A system that integrates various payment channels that facilitate electronic transactions. With interconnection and interoperability, GPN enables electronic transactions to be used by all Indonesians for domestic transactions, so that people can enjoy safe, quality and efficient electronic transaction services.

GPN cards are available in Jabodetabek and Bandung Branches starting on May 21, 2018. While other branches in other regions will be available in early June 2018.

Online Debit Card can be used for online transaction on e-commerce platform, Food Delivery / Ride Hailing Application (Gojek/Grab), or entertainment application (Netflix/Spotify), to payment transaction using Alipay / Weixin Pay for Credit Card payment during your holiday in China.

Physical Debit Card can only be used for offline transaction in physical stores and merchants through EDC and POS machine by dip in and input PIN or tap. Online Debit Card can only be used for online transaction in e-commerce platform.

Various benefits that you can enjoy with Online Debit Card such as:

Online Debit Card can be used for online transaction in any e-commerce and e-wallet platforms such as Tokopedia, Gojek & Grab or subscription-based streaming service such as Netflix and Spotify or payment in China through Alipay and Weixin Pay as a payment alternative to credit cards.

OCBC Online Debit Card is secured, supported with:

Follow these steps to create OCBC Online Debit Card

OCBC Online Debit Card can be used after 5 minutes up to 1x24 hours after creation.

You can have up to 5 Online Debit Cards, no fee for the first 3 cards and the next 2 cards will cost IDR 50,000.

OCBC Online Debit Cards are valid up to 2 years before expired and can be renewed.

Ensure your Online Debit Card's transaction limit. By default with no changes, limit of scheduled transaction set to IDR 500,000/day and limit of e-commerce shopping transaction set to IDR 5,000,000/day. Change your limit by:

Ensure to input your valid Online Debit Card number, expiry date, CVV, OTP and enough balance in your Source of Fund account for Online Debit Card.

OCBC Online Debit card can be used as an alternate credit card.

Follow these steps to link your OCBC Online Debit Card in Alipay:

Follow these steps to link your OCBC Online Debit Card in Weixin Pay:

All transactions with OCBC Online Debit Card will debit IDR account. Any transactions with foreign currencies will be converted to IDR.

Reach TANYA OCBC to ask more questions by calling phone number 1500999 or email to tanya@ocbc.id.

| Terms | OCBC Premier Voyage Credit Card | OCBC Voyage Credit Card |

|---|---|---|

| Age | Main Cardholders aged 21 - 75 years | Main Cardholders aged 21 - 65 years |

| Citizenship | Indonesian citizen and foreign national | Indonesian citizen and foreign national |

| Income | Min Revenue: IDR 100 Million per month or Min AUM: Average IDR 1 Billion for the last 3 months. |

Min Revenue: IDR 100 Million per month or Min AUM: Average IDR 1 Billion for the last 3 months. |

| Personal Identification Documents | Photocopy of KTP or Photocopy of Passport / KIMS / KITAS (For foreigners only) or Photocopy of NPWP |

Photocopy of KTP or Photocopy of Passport / KIMS / KITAS (For foreigners only) or Photocopy of NPWP |

| Income Document | A checking account with an average AUM of the last 3 months at Bank OCBC with a minimum of IDR 1 billion | A checking account with an average AUM of the last 3 months at other banks ≥ Rp 1 billion or Public Company Annual Report or Original Salary Slip or SPT. |

Exchange of Voyage Miles can be done through Voyage Exchange at +6221-26506363

Exchange your Voyage Miles for:

Always use Voyage Miles to purchase any airline ticket, and get more Frequent Flyer Miles from that airline.

Benefits of Voyage Exchange

To enjoy a variety of services above, please contact Voyage Exchange at +6221-26506363

Get comfort on every trip with the following exclusive facilities:

OCBC mobile Application *

Download the latest version of the OCBC mobile Application and follow these steps:

(* Create PIN via OCBC mobile only for Primary Card holders)"

• Sent SMS to 86477 use the following format:OCBC Mastercard ATM/Debit Card is equipped with contactless feature.

The benefit of contactless feature is cardholders can make transactions without having to insert the card into the EDC (Electronic Data Capture) machine and without having to enter a PIN for a certain transaction amount.

Example:

The OCBC debit card with the contactless feature is guaranteed to be secure because it only includes 1 code that protects the customer's payment information for each transaction and if the customer accidentally taps twice, the customer will not be billed twice.

In addition, there are already security procedures for contactless feature transactions with a nominal value of ≤ IDR 1 million without a PIN:

However, if you still don't want this feature, you can deactivate this feature independently by logging into OCBC mobile (Settings Menu → Card Settings/Card Management) or visiting OCBC branch.

This is because our Bank Regulator currently only allows ATM/Debit card transactions on the GPN (National Payment Gateway) network to be processed by reading the card chip, namely by inserting the card into the available card slot on an EDC or ATM machine.

This GPN rule does not apply to Credit Cards, therefore if you have a Bank OCBC Credit Card with a contactless feature, transactions can be made domestically.

Medical check up is required under certain conditions based on underwriting terms & conditions

(i) The Policyholder chooses to pay Premium by means of automatic debit via savings account; (ii) The Policyholder chooses to send and receive correspondence via email; (iii) The Policyholder chooses the electronic version of the Policy book; (iv) If the Policyholder has chosen the Premium payment method by automatic debit via credit card or savings account in SPAJ, the Policyholder should not make any changes to the Premium payment method during the Insurance Period; (v) Since the Policy Effective Date, no Premium has been settled after the expiry of a Grace Period; and (vi) The Policyholder has never changed the Policy into a Reduced Paid-Up Policy

Autodebit via OCBC Bank saving account

Beneficiary can complete the documents as stated in the Policy, then:

eAZy ProLife is an life insurance product that provides protection against the risk of death with affordable premiums. By having this product, you can feel calm in facing financial uncertainty for your family that may occur in the future

eAZy ProLife can be purchased independently via the Bank's mobile banking application (OCBC mobile)

The entry age limit for purchasing eAZy ProLife is 18 years - 55 years (nearest birthday)

You can choose the eAZy ProLife insurance period according to your convenience, the options are 5 or 10 years

The benefits of eAZy ProLife are Natural or Illness Death Benefits and Death Due to Accidents also Maturity Benefits if there are no claims on the End Date of Coverage in accordance with the provisions of this product.

To see details of the benefits you can take, you can read the Product Information Summary.

>Premium payments can be done via bank account autodebet according to the selected payment frequency.

eAZy ProLife premiums are quite affordable, starting from Rp. 100,000/month or Rp. 1,100,000/year. Premiums are determined based on your Age and Sum Insured. Detailed premium information can be seen in the Product Information Summary.

Those are the frequency of premium payments for eAZy ProLife product, where Annual premium is the total premium cost which must be paid once every year, Semi-annual premium is the premium which must be paid once every 6 months, Quarterly premium is the premium which must be paid once every 3 months and the monthly premium is Premium payments are made 1 month.

You will immediately be sent a link by Allianz to access the e-policy via your registered when you first made your purchase. If you choose to have the policy book sent, Allianz will send it to the registered address with a 3 days delivery TAT + Courier SLA.

Protection will be effective a maximum of 1 working day after successful premium payment

You can register eAZy ProLife for yourself where you are the Policy Holder and Insured

Your heirs can submit a death benefit claim by sending all original claim documents that have been filled in completely and correctly to the Allianz Document Management Center (ADMC). Details of the ADMC address and claim document requirements can be seen in Product Information Summary

Death benefit will be sent to the heir's account submitted based on claim’ document sent to Allianz

The expiration period for claims for death benefits is 60 days from the date the Insured dies, so that before that time period all claim documents must be sent to Allianz.

The Waiting Period is a period during which claims related to certain diseases or conditions cannot be accepted by Allianz or are not covered. Where the waiting period for the eAZy ProLife product is the first 2 policy years or the policy reinstatement date, whichever is later.

Pre-existing Condition are medical conditions that you have before purchasing this Life Insurance product.

There is no premium refund for policy surrendered.

You can contact the Allianz Customer Center (1500 136, ContactUs@allianz.co.id) or visit the Allianz website at www.allianz.co.id.

Complete the claim documents stated in the Policy, give it to the Relationship Manager of OCBC Branch to be forwarded to PT FWD Insurance Indonesia, or send it directly to the PT FWD Insurance Indonesia.

FWD Insurance Indonesia

UP: Claim Individu

Pacific Century Place, Lantai 20 SCBD Lot 10, Jl. Jendral Sudirman Kav. 52-53 Jakarta Selatan 12190

FWD Insurance Indonesia

UP: Claim Individu

Pacific Century Place, Lantai 20 SCBD Lot 10, Jl. Jendral Sudirman Kav. 52-53 Jakarta Selatan 12190

Medical check up is required under certain conditions based on underwriting terms & conditions

The insurance Premium payments will be done in autodebet periodically through OCBC account according to the selected product

Complete the claim documents stated in the Policy, give it to the Relationship Manager of OCBC Branch to be forwarded to PT FWD Insurance Indonesia, or send it directly to the PT FWD Insurance Indonesia with the following address:

FWD Insurance Indonesia

UP: Claim Individu

Pacific Century Place, Lantai 20 SCBD Lot 10, Jl. Jendral Sudirman Kav. 52-53 Jakarta Selatan 12190

Medical check up is not necessary but Customer shall provide health declaration at the time of buying the product

The insurance Premium payment will be debited/ deducted from OCBC Customer Account?

Complete the claim documents stated in the Policy, give it to the Relationship Manager of OCBC Branch to be forwarded to PT FWD Insurance Indonesia, or send it directly to the PT FWD Insurance Indonesia

FWD Insurance Indonesia

UP: Claim Individu

Pacific Century Place, Lantai 20 SCBD Lot 10, Jl. Jendral Sudirman Kav. 52-53 Jakarta Selatan 12190

Medical check up is required under certain conditions refer to underwriting terms & conditions.

Partial withdrawal can be made after the Policy Active for minimum 2 years (Terms and Conditions applied)

The beneficiary will receive the total cash value or sum insured (which one is higher)

By auto debit from OCBC saving account

Beneficiaries should:

For claims, the customer or the heirs can complete the documents as stated in the policy, then:

For claims, the customer or the heirs can complete the documents as stated in the policy, then:

Mutual fund is a capital market product, NOT PT. Bank OCBC NISP's (“Bank”) product NOR the Bank’s third-party deposit, thus it is not guaranteed by the Bank and excluded from the government guarantee program or Lembaga Penjamin Simpanan.

Before deciding to invest in Mutual Fund, the customer shall read and understand the contents of documents related to Mutual Fund products (Mutual Fund General Terms and Conditions, prospectuses, and other documents) particularly regarding the investment policies and investment risks including but not limited to risk of decline in principal, market risk, credit risk, liquidity risk, currency risk and risk of political or regulatory changes.

All investment decisions made are responsibility of the customer and the customer is willing to accept all risks arising from the investment.

Past performance is no indicative of future result.

The Bank only acts as a selling agent and the customer releases the Bank, its management and employees from all responsibilities, losses and claims, lawsuits and/or demands in any form from any third party.

| Jaringan ATM | Biaya Tarik Tunai (Rp) |

|---|---|

| Bersama/Prima | 8.000 |

| OCBC Bank Singapura | 10.000 |

| Bank Card Malaysia | 15.000 |

| Jaringan ATM | Biaya Tarik Tunai (Rp) |

|---|---|

| Bersama/Prima | 8.000 |

| OCBC Bank Singapura | 10.000 |

| Bank Card Malaysia | 15.000 |

| Jaringan ATM | Biaya Tarik Tunai (Rp) |

|---|---|

| Bersama/Prima | 8.000 |

| OCBC Bank Singapura | 10.000 |

| Bank Card Malaysia | 15.000 |

| Jaringan ATM | Biaya Tarik Tunai (Rp) |

|---|---|

| Bersama/Prima | 8.000 |

| OCBC Bank Singapura | 10.000 |

| Bank Card Malaysia | 15.000 |

Partial service fee debit is a partial deduction of service fees charged to Nyala Bisnis Customers if the average combined balance of the previous month does not meet the requirements (in this case the Customer is required to maintain an average combined balance of IDR 1 Million).

The implementation of Nyala Bisnis service fee debit will be effective on July 03, 2024, and will be carried out periodically on the 3rd day of each subsequent month.

The types of accounts that can be used as a source of funds for service fee debiting are IDR savings and/or current accounts.

The types of accounts that cannot be used as a source of fund for debiting service fees are other than IDR savings and/or current accounts, namely: Tabungan Berjangka (TAKA), Tabungan Haji, deposits, Savings with restricted status, Savings with hold status, and Savings with freeze status.

For every service fee debit activity that is carried out, it will be informed through the account mutation which can be seen in the Financial menu on OCBC mobile.

For each service charge debiting activity performed, the mutation/history can be checked through the following steps:

Service charge debiting will automatically stop if:

Customer Condition:

If the funds in the Customer's IDR savings/ current account are less than the service fee charged, the Bank will debit all funds in the account, and the remaining service fee that is not successfully debited will not be collected in the following month.

Example:

If Nyala Bisnis Customer has more than one (1) IDR savings/current account with different nominal & lower than the service fee charged, the service fee debiting system will debit from the account with the highest balance.

Example:

Nyala Bisnis Individual Customers

For Nyala Bisnis Individual Customers who do not meet the requirements for an average combined balance above Rp1,000,000 in the current month, a service fee of Rp10,000 will be charged on the 3rd day of the following month.

Nyala Bisnis Business Entity Customers

For Nyala Bisnis Business Entity Customers who do not meet the requirements for an average combined balance above Rp1,000,000 in the current month, a service fee of Rp30,000 will be charged on the 3rd day of the following month.

| Customer Type | Currently in effect | In effect per 3 July 2024 |

|---|---|---|

| Nyala Bisnis Individual Customers | If Nyala Bisnis Individual Customer fails to meet the average combined balance requirement above Rp1,000,000 in the last month, a service fee of Rp10,000 will be charged on the 3rd day of the following month. In the event that the Customer's funds in the account are insufficient to debit the service fee, it will become arrears charged to the Customer in the following month. If Nyala Bisnis Individual Customer fails to meet the average combined balance requirement above Rp1,000,000 in the last month, a service fee of Rp10,000 will be charged on the 3rd day of the following month. |

In the event that the Customer's funds are insufficient for service fee debiting, one of the following two (2) debiting methods will be applied:

The service fee will be debited against any amount of funds available in the Customer's IDR savings/giro account. The remaining service fee that is not successfully debited will not be charged to the next month's service fee. Service fee will not be debited & will not be charged to the next month's service fee. |

| Nyala Bisnis Business Entity Customers | If Nyala Bisnis Business Entity Customer fails to meet the average combined balance requirement above Rp1,000,000 in the last month, a service fee of Rp30,000 will be charged on the 3rd day of the following month. In the event that the Customer's funds in the account are insufficient to debit the service fee, it will become arrears charged to the Customer in the following month. If Nyala Bisnis Business Entity Customer fails to meet the average combined balance requirement above Rp1,000,000 in the last month, a service fee of Rp30,000 will be charged on the 3rd day of the following month. |

In the event that the Customer's funds are insufficient for service fee debiting, one of the following two (2) debiting methods will be applied:

The service fee will be debited against any amount of funds available in the Customer's IDR savings/giro account. The remaining service fee that is not successfully debited will not be charged to the next month's service fee. Service fee will not be debited & will not be charged to the next month's service fee. |

| Average Combined Balance per month | Free Transaction Fees (Quota per Month) | Service Fee (Per Month) | ||||

|---|---|---|---|---|---|---|

| Purchase/ Payment | Interbank Transfer | RTGS Transfer | BI Fast Transfer | TT | ||

| IDR 0 - < 1.000.000 | - | - | - | Unlimited | - | Free of charge |

| IDR 1.000.000 - < 10.000.000 | 5x | 5x | - | Unlimited | - | |

| IDR 10.000.000 - < 25.000.000 | 10x | 10x | - | Unlimited | - | |

| IDR 25.000.000 - < 50.000.000 | 20x | 20x | 1x | Unlimited | - | |

| IDR 50.000.000 - < 500.000.000 | 30x | 30x | 2x | Unlimited | - | |

| IDR 500.000.000 - < 1.000.000.000 | 50x | 50x | 10x | Unlimited | 1x | |

| ≥ IDR 1.000.000.000 | Unlimited | Unlimited | Unlimited | Unlimited | 1x | |

| Business Loan limit | Average Combined Balance per month | Free Transaction Fees (Quota per Month) | Service Fee (Per Month) | ||||

|---|---|---|---|---|---|---|---|

| Purchase/ Payment | Interbank Transfer | RTGS Transfer | BI Fast Transfer | TT | |||

| ≥ IDR 3.500.000.000 | < IDR 50.000.000 | 50x | 50x | 10x | Unlimited | 1x | Free of charge |

| IDR 50.000.000 - < 500.000.000 | 50x | 50x | 10x | ||||

| ≥ IDR 500.000.000 | Unlimited | Unlimited | 10x | ||||

Currently, Business Entity Customers can still enjoy unlimited quota for free transfer fees to other banks through BI FAST transfers.

The types of transactions that affected by the free interbank transfer fee quota change in the Nyala Bisnis service are RTOL and SKN/LLG.

Interbank RTOL transactions will be charged IDR 6,500 per transaction, for interbank SKN/LLG transactions will be charged IDR 2,900 per transaction (via counter) and IDR 2,000 per transaction (via Internet/Mobile/OCBC Business).

This change in the interbank transaction fee quota will take effect as of October 1, 2024.

Customers who will be affected by the change in the free interbank transfer fee quota are Business Entity Customers with Nyala Bisnis services who have:

- Minimum combined average balance in the previous month of IDR 1,000,000,000 without business loan.

- Minimum combined average balance in the previous month of IDR 500,000,000,- with a minimum business loan limit of IDR 3,500,000,000,-.

Effective as of October 1, 2024, Customers of Business Entities with the following conditions:

- Have a minimum combined average balance in the previous month of IDR 1,000,000,000 without a business loan.

- Have a minimum combined average balance in the previous month of IDR 500,000,000,- with a minimum business loan limit of IDR 3,500,000,000,-.

The maximum quota for free interbank transfer fee via RTOL and SKN/LLG is 1000 times per month from the previous quota of unlimited limit.

The change in the free interbank transfer fee quota only applies to Nyala Bisnis Business Entity Customers while there is no change to the free interbank transfer fee quota for Nyala Bisnis Individual Customers.

| Customer Type | Currently in effect | In effect per 1 October 2024 |

|---|---|---|

| Nyala Bisnis Business Entity Customers |

|

|

*Interbank transfers beyond the quota will be charged a fee of IDR 6,500 per RTOL transaction & IDR 2,900 per transaction (via counter) or IDR 2,000 per transaction (via Internet/Mobile/OCBC Business) for SKN/LLG.

| Jaringan ATM | Biaya Tarik Tunai (Rp) |

|---|---|

| Bersama/Prima | 8.000 |

| OCBC Bank Singapura | 10.000 |

| Bank Card Malaysia | 15.000 |

| Jaringan ATM | Biaya Tarik Tunai (Rp) |

|---|---|

| Bersama/Prima | 8.000 |

| OCBC Bank Singapura | 10.000 |

| Bank Card Malaysia | 15.000 |

| Jaringan ATM | Biaya Tarik Tunai (Rp) |

|---|---|

| Bersama/Prima | 8.000 |

| OCBC Bank Singapura | 10.000 |

| Bank Card Malaysia | 15.000 |

| Jaringan ATM | Biaya Tarik Tunai (Rp) |

|---|---|

| Bersama/Prima | 8.000 |

| OCBC Bank Singapura | 10.000 |

| Bank Card Malaysia | 15.000 |

*follow the terms and conditions applicable to OCBC

Gold Savings is a service owned by Pegadaian that is in the OCBC mobile application through a collaboration between Bank OCBC and Pegadaian which allows customers to carry out gold investment activities electronically through the OCBC mobile application.

Until now, there are several features that can be used by the Customer, namely:

Related to point 1 above, for customers who use multicurrency accounts (Tanda 360 Plus and Tanda 360 Plus Employees), only Rupiah accounts can be used for transactions on the Gold Savings service.

Yes, with the following steps:

Custody fees. For this fee, in the first year it is not charged by the Pegadaian. Fees will be charged for the following year in accordance with the rules that apply at Pegadaian

Yes, with the following steps:

Yes, here is the minimum or maximum purchase limit for gold:

To make purchases on the second day and beyond, follow the flow similar to that of Initial Deposit. The difference is only in the limit of buying gold transactions.

Yes, here is the minimum or maximum gold purchase limit on the second day and so on:

Yes, with the following steps:

Yes, here are the minimum or maximum gold purchase limits for the second time and so on:

Mandatory, equal to 0.05 grams of gold so that the account does not become dormant

Yes, with the following steps:

Yes, with the following steps:

Can. The customer can print gold by coming to the Pegadaian Outlet chosen by the customer

Yes, the minimum number of grams that can be printed is according to what is available at the Pegadaian

Gold in the Gold Savings product is not guaranteed by the Deposit Insurance Corporation (LPS) because it is not a bank product.

For the current OCBC mobile version, it still doesn't work

Customers can contact Bank OCBC through the Contact Center to find out data that is not appropriate

The customer re-registers

Customers can contact Bank OCBC through the Contact Center to find out data that is not appropriate

| Jaringan ATM | Biaya Tarik Tunai (Rp) |

|---|---|

| Bersama/Prima | 8.000 |

| OCBC Bank Singapura | 10.000 |

| Bank Card Malaysia | 15.000 |

Frequently Asked Questions about information on changes to the OCBC mobile display click here

Step change personal data such as email, address & occupation via OCBC mobile click here

*for series other than ORI, SR, SBR and ST

| Destination Currency | Transaction Cut Off Time |

| AUD | 10:00 |

| CAD | 14:00 |

| CHF | 14:00 |

| CNH | 14:00 |

| EUR | 14:00 |

| GBP | 14:00 |

| HKD | 10:00 |

| JPY | 10:00 |

| NZD | 10:00 |

| SGD | 14:00 |

| USD | 14:00 |

Note: Funds can be received on the same day if the data provided is complete and not held by the correspondent bank.

Currently, activation can be done in 2 ways:

ONe Mobile currently has the capability to activate Credit Card for online transaction although you haven’t received your Credit Card. The purpose of this is so that you can do online transaction without waiting for the physical card to arrive. After activation for online transaction is done, you can see the details of Expiry Date and CVV in ONe Mobile for online transactions.

Customer can make transaction with the same foreign currency 24 hours every day.

Customer can make transaction with different foreign currencies on weekdays from 05:00-17:00 WIB.

No, transfers to other banks with same or different currency are only available on weekdays from 05:00-14:00 WIB.

The purchase of e-voucher games through OCBC Mobile is free of admin fees in accordance with the Terms & Conditions of Customer's financial services.

Currently, e-vouchers are available on OCBC mobile (Android only), Internet Banking, and ATMs (excluding Playstation vouchers).

Especially for PlayStation, the maximum limit for purchasing vouchers is IDR 10,000,000 per day (accumulation).

Yes, I can buy e-vouchers for games and share voucher codes with others.

If there is a problem when redeeming Playstation voucher code, customers can directly contact PlayStation support contacts either through the Call Center or Website.

For PlayStation, the use of the voucher code purchased is subject to the Terms and Conditions of Service and the PSN (PlayStation Network) User Agreement. Further information can be found at the following link https://doc.dl.playstation.net/doc/legal/

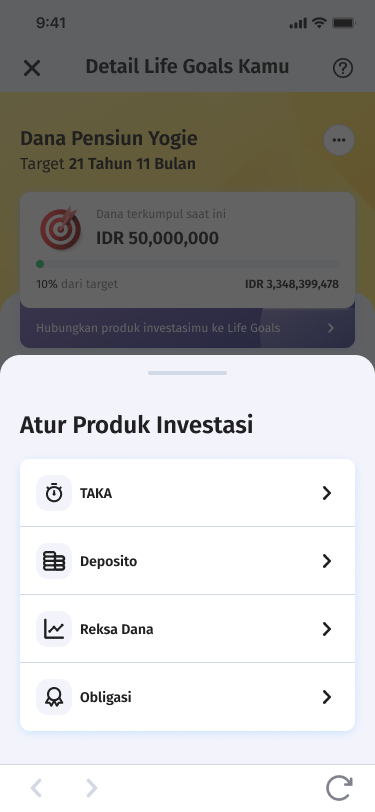

B: Life Goals is OCBC mobile’s feature which helps you to manage way of saving become easier. You can create Life Goals according to your needs and connect your investment products to meet your target funds.

B: With Life Goals, you can be more disciplined in investing thus your investment goals or long-term goals in your life will be more focused and can be realized through Life Goals feature which monitored and customized.

B: Step to Create Life Goals:

B: You can choose these categories: Pension Fund, Education, Travel, Marriage, Religious Tourism & many more.

B: You can choose ‘Others’ category and filled the Life Goals data accordance to your needs such as business capital, medical expenses, and more.

B: No, I am free to input any nominal here according to the funds that I have been prepared—not necessarily according to the value of the assets owned in OCBC mobile.

The example of filling funds that I Have Prepared’:

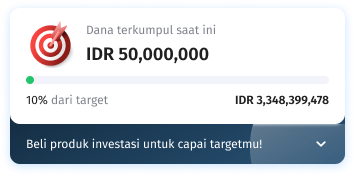

B: No, achievement in Life Goals shown on the goal tracker, will only updated according to the nominal entered in the ‘Funds you have prepared’ and according to the value of the investment product that has been linked to Life Goals.

Display goal tracker in Life Goals details:

B: Goal tracker is an indicator of the achievement of your Life Goals that shows:

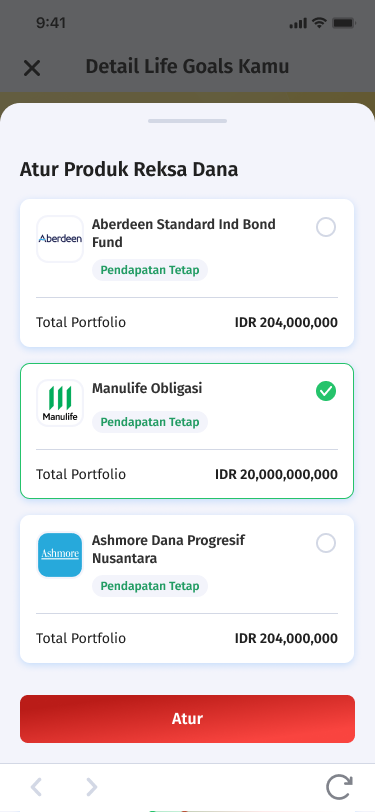

B: Currently, Life Goals can only be linked to products Reguler Saving Plans, Deposit, Mutual Funds and Bond.

B: No, 1 (one) product can only be linked to 1 (one) Life Goals.

B: You can link or unlink investment product in Life Goals. You can set the investment product that you want to link your Life Goals, via the product page on OCBC mobile, via banner or slider on the Life Goals detail page.

Link product via OCBC mobile:

Link product on Life Goals detail banner:

or on Life Goals detail slider:

B: Yes, if there is a deposit product that is due date or withdraw before the date, the goal tracker will be reduced according to the amount returned to savings.

B: Currently there is a banner under the goal tracker in the Life Goals detail that inform you:

Banner A:

Banner B:

B: Your will get notification if there is a product Reguler Saving Plans or Deposit linked to your Life Goals but is due date, so the product will automatically be disconnected from your Life Goals while reducing the calculation in the goal tracker.

Notification display for Reguler Saving Plans when due date:

B: Currently, Life Goals cannot be shared with others. You can only link your own investment product to the Life Goals you have created.

B: The goal tracker data on the chart will be updated every time you open the Life Goals detail.

B: The target fund is adjusted to the inflation assumption from data of the latest 10 years, and the estimated performance of investment products.

B: Factor for calculating Life Goals:

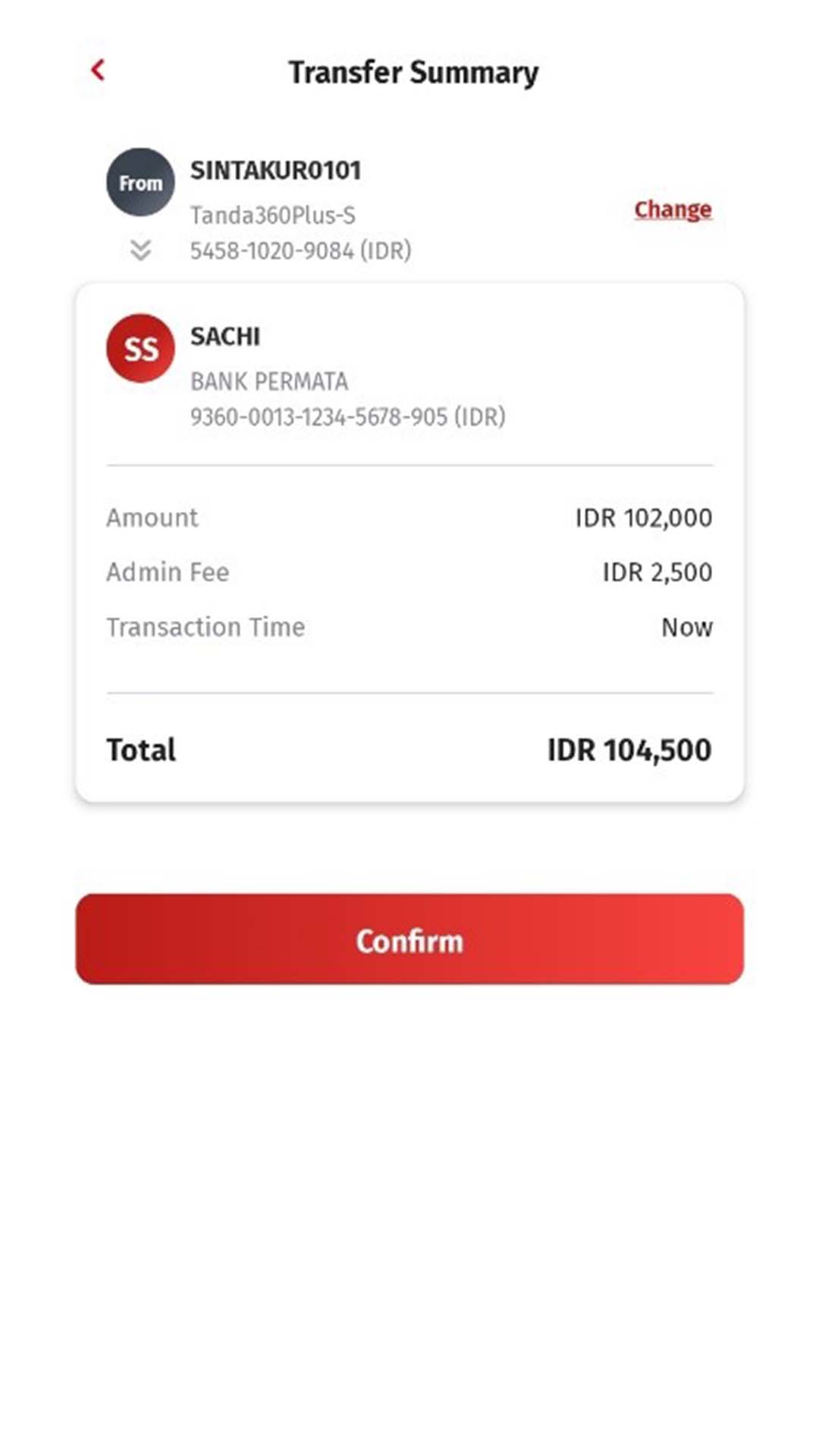

BI-FAST is retail payment methods that customers can choose either at OCBC mobile, branch or Velocity.

Yes, you can transfer BI-FAST at branch by adjusting branch operational time.

Yes, recipients can receive transfer funds in real time.

BI-FAST makes transfer feature easier, not only with account number, but also with input mobile number and email address of the transfer recipient which has been previously registered in proxy address.

Currently, proxy registration can be through OCBC branches and will be coming soon in OCBC e-channel.

No, 1 mobile number or 1 email can only use for 1 account.

The proxy address maintenance process can do at OCBC branch and will be available on e-channels.

Currently, BI-FAST can only transfer Rupiah to Rupiah.

BI-FAST transfer is available 24/7

Because account connected to proxy BI-FAST can change according to the account owner, so it can change the destination that has been set.

Yes, currently BI-FAST transfers using account number or proxy able to do multiple transfer as long as the source of funds used is in Rupiah.

This may happen because the destination account number had not been registered in any bank’s proxy address. Make sure your transfer destination has registered an account with a proxy address. Or problems with BI-FAST network, problem with beneficiary bank, or registered account is no longer active,

This can happen because the transfer destination bank doesn’t yet have a BI-FAST transfer method. As of February 2022, only 40 destination banks can accept transfer with BI-FAST, such as Allo Bank Indonesia, Bank Bali, BCA, BCA Syariah, Bank BTN, Bank BTN UUS, Bank CIMB Niaga, Bank CIMB Niaga UUS, BRI, Bank Sinarmas, Bank Sinarmas Syariah, Bank Citibank NA, Bank Danamon Indonesia, Bank Danamon Indonesia UUS, Bank DBS Indonesia, Bank Digital BCA, Bank Ganesha, Bank HSBC, Bank Jawa Barat & Banten, Bank Sahabat Sampoerna, Bank Jawa Tengah, Bank Jawa Tengah Syariah, Bank Jawa Timur, Bank Jawa Timur UUS, Bank KEB Hana Indonesia, Bank Mandiri, Bank mandiri Taspen, Bank Maspion, Bank UOB Indonesia, Bank Woori Saudara Indonesia, Bank Mestika Dharma, Bank Multi Arta Sentosa, Bank Nasional Nobu, Bank Negara Indonesia, Bank Nusa Tenggara Timur, Bank Papua, Bank Permata, Bank Permata UUS, dan PAN Indonesia Bank.

BI-FAST free transfer program for Nyala and Premier Banking customer. Free transfer program for OCBC Business will follow soon.

For Nyala and Premier Banking customers with a combined balance above the program terms and conditions, transfer fee will be removed from customer’s account. For Nyala and Premier Banking below the term and conditions, transfer fee will be drawn and will be returned in cashback on the 4th week of the following month. For Premier Banking who transact with BI-FAST through branches (don’t see combined balance), transfer fee will be given in cashback in the 4th of the following month.

Calculation of the combined balance of the Nyala and Premier Banking customers following the terms and conditions of each service Nyala or Premier Banking.

In branch, customers can make transactions of IDR 250 million per transaction with unlimited limits every day.

The Steps are easy:

The Steps are easy:

If the information is not correct, you can immediately contact TANYA 1500-999 or go to the branch to update customer data.

1 account can only register on 1 mobile number or email, so maybe your mobile number or email has been used in another account or other bank. Or the connected mobile number already blocked, so you have to unblock it at the other bank.

You can directly porting in OCBC mobile App. But, if there is an error, please remove mobile number or email address from previous bank.

Block feature is a temporary closure feature, while delete proxy feature aims to disconnect the account number and proxy data. The difference is if your mobile number or email is blocked by one of the banks. You can’t use mobile number or email for porting to your OCBC account because the status still connected.

This can happen because of the report to blocked or a fraud anomaly is detected.

You can come to the branch to unblock it.

A : Face-to-face verification between a customer and an officer of Bank OCBC is required to ensure the authenticity of the customer and their data. This process is mandatory so that customers can do banking transactions and enjoy all services available on OCBC mobile.

A : Customers must prepare e-KTP and other additional IDs such as SIM, passport, diploma, Buku Nikah or Kartu Keluarga (KK).

A : You can do the Video KYC process by following these steps:

A : You can set a schedule for the Video KYC process by following these steps:

A : If you want to change your Video KYC schedule, you can follow these steps:

A : You can still do the Video KYC process before the schedule you set by following these steps:

A : If the Video KYC schedule is fully booked/unavailable, you can try calling our agents directly by following these steps:

A : If you have not made an initial deposit, you must finish the Video KYC process before the 30 days since you registered your account. If you have made an initial deposit, you must do the Video KYC process before the 60 days since you registered your account, after 60 days your account status will become ‘dormant’.

For further inquiries:

Please contact TANYA OCBC at 1500-999

Quick Response Code Indonesian Standard (QRIS) is a QR Code-based payment method standardized by Bank Indonesia (BI). With QRIS, all QR Code-based payment transactions can be carried out through all payment applications, whether based on mobile banking or electronic money. QRIS aims to increase the ease, security and comfort of transactions.

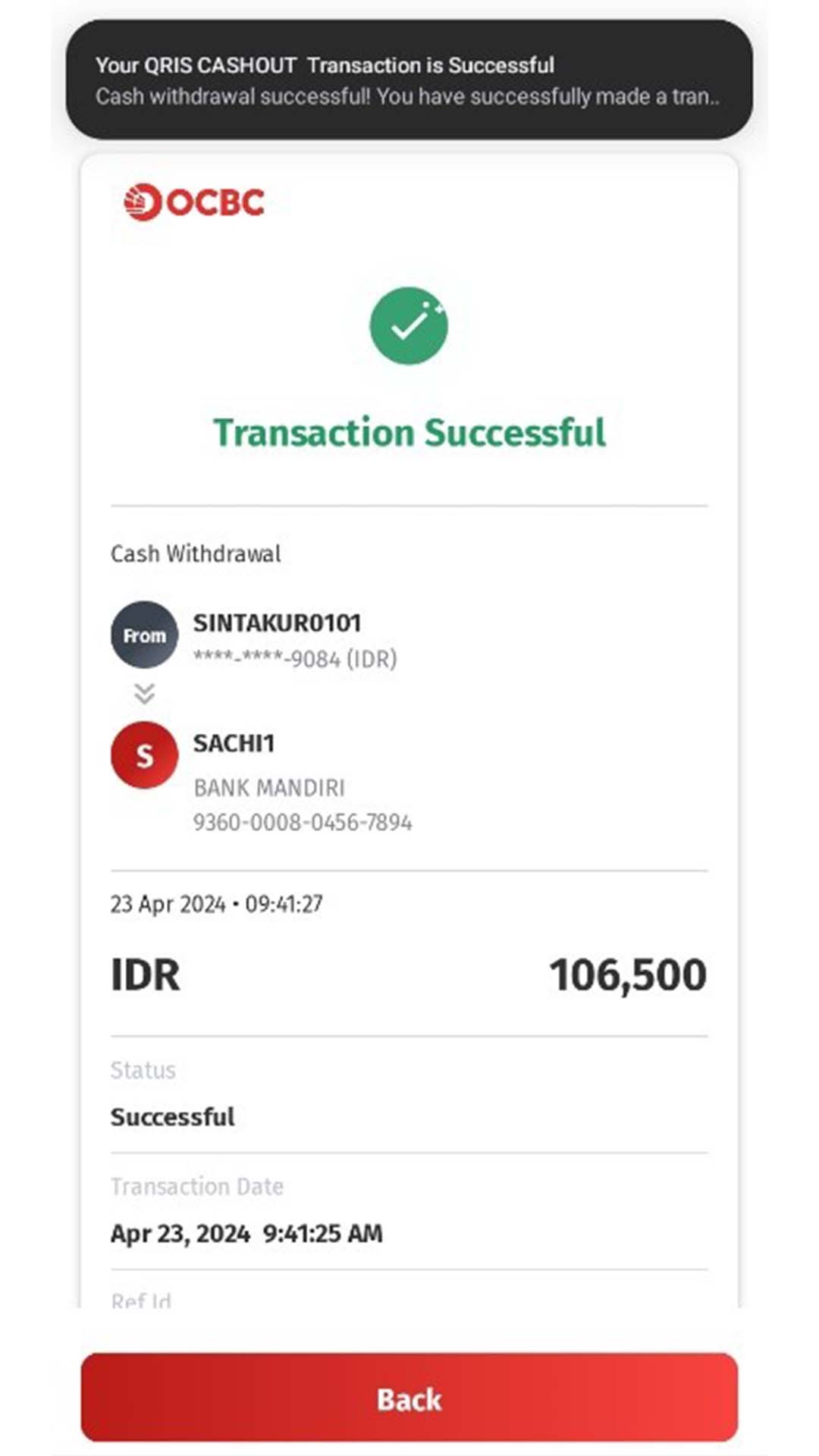

QRIS Tuntas (Transfer, Cash Withdrawal and Cash Deposit) is a feature initiated by Bank Indonesia to provide cash withdrawals, transfers and cash deposits between QRIS users. Customers only need to provide QRIS (generate) and/or scan QRIS to complete the QRIS transaction.

QRIS Transfer is a QRIS TUNTAS feature service in the form of a QR code that can be used to transfer funds between OCBC accounts (intrabank), between banks, and between electronic wallets (e-wallets).

QRIS Tarik Tunai is a QRIS TUNTAS feature service for making cash withdrawals through merchants who have become BI Digital Financial Services (LKD) agents or Financial Services Authority (OJK) Laku Pandai agents and certain ATM machines by scanning the QRIS displayed by the merchant and ATM machine which serves the QRIS Cash Withdrawal feature

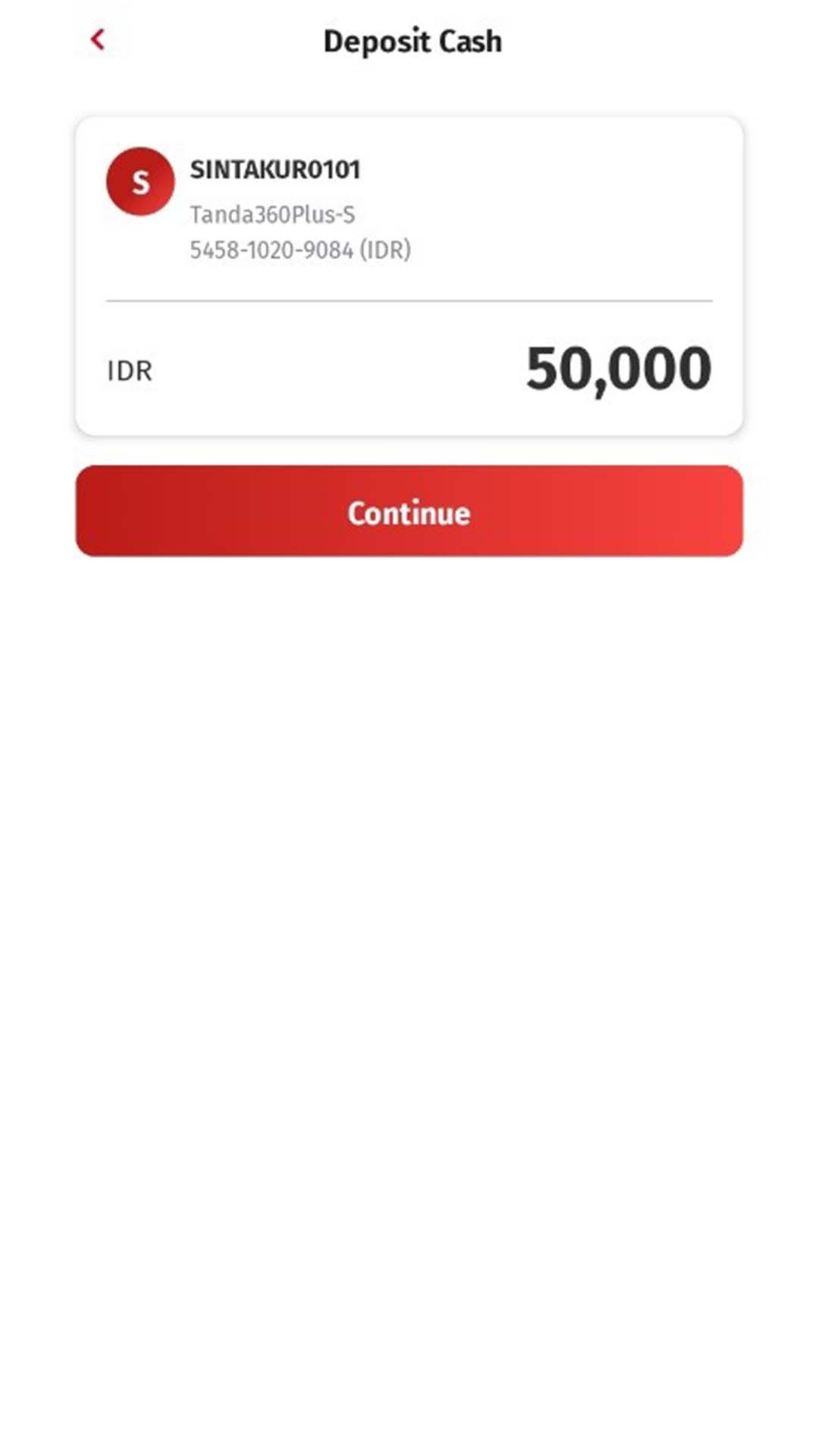

QRIS Setor Tunai is a QRIS TUNTAS feature service for making cash deposits through merchants who have become BI Digital Financial Services (LKD) agents or Laku Pandai agents of the Financial Services Authority (OJK) and certain ATM machines by scanning QRIS at merchants and ATM machines that serve QRIS Cash Deposit feature

All OCBC Bank customers who have registered for the OCBC mobile application can use QRIS Tuntas feature. The QRIS Tuntas feature can be done via your OCBC mobile application via the menu:

You can access and use the QRIS Tuntas feature to make and receive fund transfers on OCBC mobile in the following ways:

Making a Fund Transfer:

Receiving Fund Transfers:

| QRIS | Transfer | Tarik Tunai | Setor Tunai |

|---|---|---|---|

| Transcation Fee | Transfer Out:

|

Rp. 6,500,- per transaction. This fee applies to both on US (intra PJP) and off us (inter PJP) transactions. | Rp. 5,000,- per transaction. This fee is for on us and off us transactions via QRIS/ATM agents/merchants |

| QRIS | Transfer | Tarik Tunai | Setor Tunai |

|---|---|---|---|

| Transaction Limit | Referring to the QRIS provisions Rp. 10,000,000,- per transaction | Referring to the QRIS provisions Rp. 10,000,000,- per transaction | Referring to the QRIS provisions Rp. 10,000,000,- per transaction |

No, Complete QRIS transaction fees for transferring funds are not included in the free transfer benefit on Nyala, Nyala Payroll, Premier or Private services.

The minimum nominal amount for carrying out Complete QRIS to make and receive fund transfers, cash withdrawals and cash deposits starts from IDR 1,- and a maximum of IDR 10,000,000,- per transaction.

You get transaction notifications for every successful and failed transaction. You can immediately get notifications as soon as processing is complete. Make sure you have activated the push-notification feature for your OCBC mobile to get notifications.

You can submit a claim to the merchant where you made the Cash Deposit transaction. The required proof and transaction details can be accessed via the Online Transaction Details menu.

Cash Withdrawal Transactions: If the merchant's QR cannot be scanned so that cash withdrawals cannot be made, the customer can submit a complaint to the OCBC complaint service

Transfer Out Transaction: If the customer cannot scan the QR of the destination bank, the customer can submit a complaint to the OCBC complaint service

Transfer In Transaction: If the QR that is generated cannot be scanned or if it has been scanned but the funds are not credited, the customer can submit a complaint to the OCBC complaint service

QRIS TUNTAS transactions can be used to carry out Transfer, Cash Withdrawal and Cash Deposit transactions, make sure that when scanning the QRIS code, the information displayed is appropriate.

If the transfer, cash withdrawal and cash deposit status is pending (in progress), the customer can check the account mutation, if it is declared unsuccessful or not recorded, the customer can carry out the transaction again.

f the transfer status, cash withdrawal is unsuccessful (failed) but the balance is deducted, the QR cannot be scanned and the cash deposit status is unsuccessful but the funds do not increase, the customer can check the account mutation for an automatic refund or can submit a complaint via:

You can submit questions and complaints via:

| TYPES OF TRANSACTION | CURRENCY | ||||

|---|---|---|---|---|---|

| IDR | Foreign Currency | ||||

| OCBC Intrabank Transfer | |||||

| To own account | IDR | 2,000,000,000 | USD | 25,000 (equivalent)* | |

| To other OCBC account | IDR | 1,000,000,000 | USD | 25,000 (equivalent)* | |

| Interbank Transfer | |||||

| Online | IDR | 200,000,000/day 50,000,000/transaction |

|||

| LLG | IDR | 1,000,000,000 | N/A | ||

| RTGS | IDR | 10,000,000,000 | |||

| Telegraphic Transfer | USD | 25,000 (equivalent)* | |||

| Payment | IDR | 500.000.000 | N/A | |

|

|

IDR | 5.000.000 | N/A | |

|

* Monthly transaction limit

Types of Funds Transfer to Other Banks :

OCBC Wallet is server based electronic money that can be accessed directly through smartphone and allows its user to make banking transactions such as purchase phone credit, transfer between OCBC Wallet, transfer to OCBC, interbank transfer and cash withdrawal in OCBC ATM Machine.

How to download OCBC Wallet App?You can download OCBC Wallet app in Google Play Store (for Android) and Appstore (for iPhone). Insert keyword “OCBC Wallet” on search coloumn to make it easier. Click “Install” to start downloading the app. For your safety and convenience in making transaction with OCBC Wallet, make sure that your phone’s operational system has bee updated (iOS min. V. 11 or Android min. V. 5).

What are the benefits of OCBC Wallet by OCBC?Several benefits that users can get as stated below:

Features of OCBC Wallet by OCBC that users can enjoy as stated below:

For unregistered OCBC Wallet user:

For registered OCBC Wallet user:

You can register OCBC Wallet by following below steps:

User that has made the registration will be registered as Unregistered User. To be able to become Registered user, user have to upgrade OCBC Wallet by OCBC service.

How to Upgrade OCBC Wallet Service to become Registered user?If you want to upgrade the service, make sure that you are customer of OCBC. Upgrade OCBC Wallet service can be done by following steps below:

Top Up Balance OCBC Wallet can be done in several ways:

Make sure that you have upgraded OCBC Wallet to Registered user and using OCBC ATM Facility. On OCBC Wallet app in your device, choose Cash Withdrawal. Fill amount that wanted, then insert your PIN. OTP code will be sent via message to your device.

On OCBC ATM Machine, choose CARDLESS WITHDRAWAL, choose OCBC WALLET VIA OTP. When there are requested to fill in your phone number, input your OCBC Wallet phone number, choose CORRECT. Insert OTP code from message in your device.

One phone number can only be registered once.

Can I have more than one account of OCBC Wallet?Can, but it must be from different phone number.

Can I access OCBC Wallet service from overseas?User can access OCBC Wallet service from overseas as long as user has internet connection (for smartphone user).

Is there a minimum balance on OCBC Wallet account?There is no minimum balance on OCBC Wallet account

Is there administration fee for OCBC Wallet and rates as regular saving account ?According to Bank Indonesia’s Terms and Conditions, there are no adminsitration fee and rates for OCBC Wallet account.

If I want to transfer some money, how long it will take to be received by recipient?Transfer transaction use online dan real-time method. After transfer process, then sender will receive transfer receipt and can see account mutation has been debited. Recipient can directly check the successful transaction by checking account mutation, according with the applicable process at the recipient institution.

How to transfer to OCBC Wallet user?Make sure that you have upgraded OCBC Wallet to Registered user. Click OCBC Wallet Transfer on Menu. Insert destination phone number of OCBC Wallet according to procedure, click Continue. Insert transaction’s amount, click Continue. Wait until transaction confirmation appear, click Continue and OTP Code will be sent. Input OTP and OCBC Wallet PIN, click Continue, wait until you get Transaction Receipt.

How to transfer to OCBC account?Make sure that you have upgraded OCBC Wallet to Registered user. Choose Bank Transfer on Menu. Choose Bank OCBC, then input destination account number, click Continue. Insert transaction’s amount, click Continur. Wait until transaction confirmation appear, click Continue and OTP Code will be sent. Input OTP and OCBC Wallet PIN, click Continue, wait until you get Transaction Receipt.

How much is the transfer fee to Bank account (OCBC/ Other Bank )?Transfer is one of the OCBC Wallet feature that allows you to transfer from OCBC Wallet account yo other OCBC Wallet account and also transfer to bank account. This transfer feature is free from charge for transfer to other OCBC Wallet user, for transfer to other bank account will be charged according to terms and conditions that applied.

You can find out more about information regarding the closure of ONe Wallet here

If I experience problems or have questions regarding OCBC Wallet, where can I get information?You can ask questions or tell your problem that you experienced by sending email to tanya@ocbc.id, or contact Tanya OCBC 1500-999/66-999(phone), or visit nearest OCBC Branches.

How can I know the location of OCBC ATM or nearest OCBC Branches?You can visit OCBC website on www.ocbc.id or contact Tanya OCBC 1500-999/66-999

What can I do if my SIM Card and/or my phone is lost or stolen?User can block and reposrt the loss to phone provider and contact Tanya OCBC 1500-999 to continue the process. If user want ask reqeust to unblocking, then user can contact Tanya OCBC 1500-999/66-999(Phone)

Will I lose my money in my OCBC Wallet account if my SIM Card and/or my phone is lost or stolen?No, Your money is safe in OCBC Wallet account, as long as there are no other parties that know your PIN and Secret Question.

What should I do to get my balance back on my OCBC Wallet account, if my SIM Card and/or my phone is lost or stolen?Balance on your OCBC Wallet account will be safe as long as nobody know about your PIN and Secret Question. You can contact your phone provider.

You can’t access your account by using other phone number. Other alternative to get your balance back by making cash withdrawal transaction. So, you need to close your account and withdraw all your balance on your OCBC Wallet account, by visiting your nearest OCBC Branches. For unregistered user, you need to bring statement letter from your phone provider stated that you are phone number user that used for OCBC Wallet account. For further information, contact Tanya OCBC at 1500-999/66-999(Phone).

How can I avoid fraud in transactions?You can anticipate by avoiding some action such as accept stranger invitation to the ATM, br careful for every phone conversation from stranger and asking about your personal data including your latest balance information, give information about OTP code that you received from message. You have to re-check regarding your transaction when there is transfer report from other parties.

How to close OCBC Wallet account?For registered and unregistered user can close the account from nearest branches by filling in OCBC Wallet closing account form.

QRIS (Quick Response Code Indonesian Standard) is a QR Code-based payment method standardized by Bank Indonesia (BI). With QRIS, all QR Code-based payments can be made through all payment applications either on mobile banking or electronic money by means of interconnection and interoperability. QRIS aims to increase ease, security and convenience of transactions.

Everyone who already has OCBC Wallet, whether as an Unregistered or Registered user.

OCBC Wallet users do not need to re-register to be able to use QRIS. OCBC Wallet users can directly use the QRIS payment method through the OCBC Wallet application.

You can access and use QRIS payments on OCBC Wallet as follows:

| Unregistered | Registered | |

|---|---|---|

| Maximum Limit per Transaction | Rp2.000.000 | Rp10.000.000 |

| Maximum Limit per Day | Rp10.000.000 | Rp10.000.000 |

OCBC Wallet users will not be charged any fee when using QRIS. OCBC Wallet users only need to pay the total value of the transactions that have been made at the merchant/outlet/store.

OCBC Wallet users can transact at any merchant that has a QRIS logo that looks like the following:

After making a payment, the system will display a proof of payment with information in the form of Ref No, Transaction Time and Date, Merchant Name, Paid Amount and Status of the transaction.

For transactions which are debited twice, you can request refund for excess transactions to merchants where you made transactions. For proof and transaction details required, they can be accessed through Main Page in OCBC Wallet.

Please make sure you have the latest/ most updated version of OCBC Wallet

| Transaksi | Biaya |

|---|---|

| Transfer Dana | |

| Transfer anter Pengguna OCBC Wallet | Gratis / Tidak dikenakan biaya |

| Transfer ke Bank Lain (Online) | Rp6.500 |

| Pembayaran | |

| QRIS | Gratis / Tidak dikenakan biaya |

| Pembelian Pulsa Isi Ulang | |

| Telkomsel XL Indosat Tri Smartfren |

Gratis / Tidak dikenakan biaya |

| ATM network | Cash Withdrawal Fee (Rp) |

|---|---|

| Bersama/Prima | IDR 8.000 |

| OCBC Bank Singapura | IDR 10.000 |

| Bank Card Malaysia | IDR 15.000 |

1. Apa yang dimaksud transfer dengan BI FAST?

BI FAST adalah sistem layanan yang dikembangkan Bank Indonesia untuk menciptakan infrastruktur sistem pembayaran ritel nasional yang lebih efisien dalam mengakomodir transfer dana secara real time, tersedia dalam 24/7..

2. Apa keuntungan transfer dengan BI FAST?

- Cepat : Transfer online dan dapat diterima secara real time

- Aman : Sistem pembayaran resmi dari Bank Indonesia

- Simpel : Bisa dengan nomor Rekening, nomor Ponsel dan alamat email

- Hemat : Biaya transaksi hanya Rp2500,- dengan limit transfer hingga Rp250 Juta per transaksi

3. Apakah saya bisa melakukan transfer BI FAST di Cabang?

Ya, Anda bisa melakukan transfer dengan BI FAST di Cabang dengan menyesuaikan waktu operasional Cabang (saat ini mulai pukul 08:00 – 14:30 waktu setempat).

4. Berapa limit transfer BI FAST?

Limit transaksi dengan BI FAST adalah Rp 250.000.000 per transaksi

5. Apakah transfer BI FAST diterima oleh penerima transfer secara real time?

Ya, penerima bisa menerima dana transfer secara real time.

6. Apa yang dimaksud dengan metode transfer dengan proxy address pada BI FAST?

Untuk memudahkan transaksi, nasabah bisa mendaftarkan alamat email atau nomor ponsel sebagai pengganti nomor rekening, sehingga dengan proxy address nasabah tidak perlu menginput nomor rekening ataupun bank tujuan.

7. Bagaimana cara mendaftarkan email dan nomor handphone sebagai proxy?

Saat ini pendaftaran proxy dapat dilakukan melalui Cabang OCBC dan akan segera hadir di e-channel OCBC

8. Apakah 1 nomor ponsel/ alamat email bisa digunakan untuk beberapa nomor rekening/ proxy address?

Tidak bisa. 1 nomor ponsel/ 1 alamat email hanya bisa mewakili 1 rekening saja secara nasional di seluruh Bank di Indonesia.

9. Jika nomor ponsel lama saya sebagai proxy address sudah tidak saya gunakan, bagaimana cara saya menghapus nomor ponsel tersebut?

Proses maintenance proxy address dapat dilakukan melalui Cabang OCBC.

The whistleblowing channels that can be used are as follows:

| Jaringan ATM | Biaya Tarik Tunai (Rp) |

|---|---|

| Bersama/Prima | 8.000 |

| OCBC Bank Singapura | 10.000 |

| Bank Card Malaysia | 15.000 |

| Jaringan ATM | Biaya Tarik Tunai (Rp) |

|---|---|

| Bersama/Prima | 8.000 |

| OCBC Bank Singapura | 10.000 |

| Bank Card Malaysia | 15.000 |

| Jaringan ATM | Biaya Tarik Tunai (Rp) |

|---|---|

| Bersama/Prima | 8.000 |

| OCBC Bank Singapura | 10.000 |

| Bank Card Malaysia | 15.000 |

Our team is ready to help