Join Nyala, and get the reward!

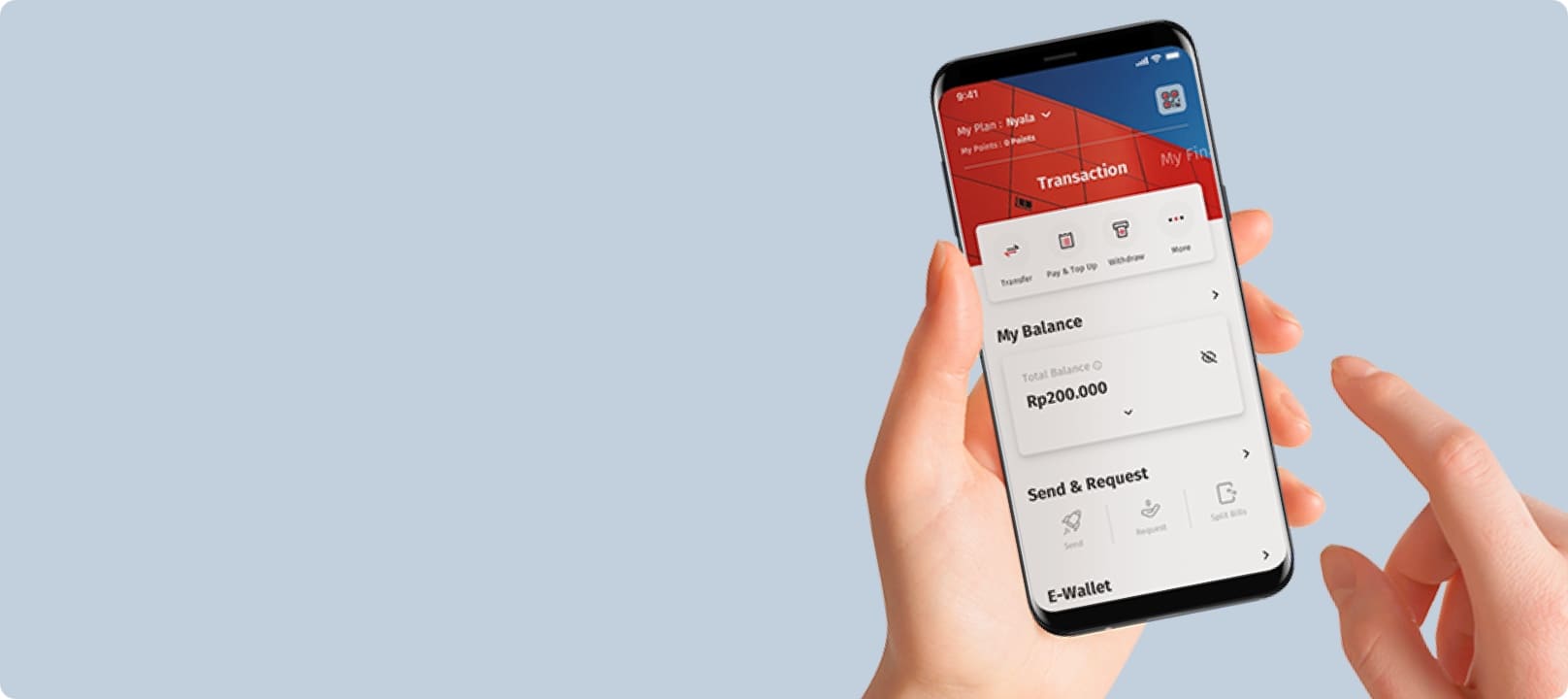

Register Nyala by visiting the nearest PT Bank OCBC NISP Tbk (”OCBC”) branch or via OCBC mobile.

- Choose total combined fund balance to get reward up to IDR 380,000

- Open new product* to get reward up to IDR 540,000 (max. 3 products)

*Reward for new product only applicable for minimum total combined fund IDR 25 Million.

Choice of products included in the Nyala Banyak Cuan Program (“Program”):

- Make transaction via OCBC mobile and get reward up to IDR 36,000/month**

** Reward for transaction only applicable for minimum total fund IDR 25 Million and valid for 3 months form the account opening month.

Terms & Conditions Nyala Banyak Cuan Program:

- Valid for:

- New Customers, OR

- Existing Customers provided that as of December 31, 2024, all OCBC accounts have been closed and they do not hold any other products except for OCBC Credit Cards.

- Customers must enter NEA25 promo code while open an account.

- Customers must be registered to Nyala or Nyala Payroll services (not applicable for Nyala Bisnis).

- Funds and product placement must originating from other bank (Fresh Funds) and cannot be transferred from other OCBC accounts.

Example: Customer join with total combined fund balance IDR 2 Million and fund placement IDR 1 Million from other bank and overbooking IDR 1 Million. Therefore, Customer is not eligible because the funds are not fresh funds.

- Fulfillment of general requirements including promo code, fresh fund and total combined fund balance must be performed at the latest within the end of 2nd month since account opening.

Example: If the first month Customer has fulfilled the requirements for the Total Combined Balance, then Total Combined Balance reward will be paid immediately without waiting for the end of the second month.

- Reward for total combined fund balance placement does not apply to multiples.

- Fulfilment of new product placement requirement must be performed at the latest within the end of the 3rd month since account opening.

- Reward for new product placement is only valid for total combined fund balance min. IDR 25 Million and applies to max. products.

- Fulfilment od transaction requirement can be done until at the end of the 3rd month since account opening and only applies for min. total combined fund balance IDR 25 Million during transaction month.

- The Program Reward (cashback) will be credited to the customer’s account no later than the 4th week of the third month after account opening with the following crediting details.

Example: If a customer opens an account in August 2025, the fulfilment of total combined fund balance must be performed within the end of September 2025 and new product placement must be performed within the end of October 2025. Cashback will be credited within the 4th week of November 2025.

- Customers must ensure that the account is active and not blocked/restricted for any reasons at the time the payment of the program reward is credited by the Bank. If at the of reward payment the account status is not active or is blocked, the payment will be made in the 4th week of the following month.

- Each Customer is allowed only 1 (one) New Customer program.

- This program cannot be combined with other new customer programs.

- OCBC has the right to not processing/cancelling the provision of cashback to Customers who, based on OCBC’s assessment, are indicated to have committed fraud on account opening and/or included in OCBC’s fraud list.

- For further information, contact Tanya ICBC 1500-999 or visit the OCBC website at www.ocbc.id

- The Terms and Conditions of this Program have been adjusted in accordance with the provisions of statutory regulations, including the regulations of the Financial Services Authority (OJK).

- OCBC has the right and authority to modify, add, and/or reduce these Terms and Conditions with notification through media deemed appropriate by the bank, considering the legal regulations and legislation in force.

PT Bank OCBC NISP Tbk is licensed and supervised by the Indonesian Financial Services Authority (OJK) & Bank Indonesia, and is a guaranteed member of Indonesia Deposit Insurance Corporation (LPS)