Jakarta, 3 July 2025 — As part of its efforts to support the acceleration of digitalization among micro, small, and medium enterprises (MSMEs) in Indonesia, OCBC launches OCBC Merchant, a digital platform that enables business owners to accept cashless payments easily and efficiently.

In 2023, data from the Indonesian Chamber of Commerce and Industry (Kadin) recorded that the number of MSMEs in Indonesia reached 66 million. These businesses contributed 61% of Indonesia’s Gross Domestic Product (GDP), equivalent to IDR9,580 trillion . In line with Bank Indonesia’s target to encourage 58 million MSMEs to adopt QRIS by 2025, OCBC is committed to being part of the solution by offering digital innovations that directly address the needs of business owners.

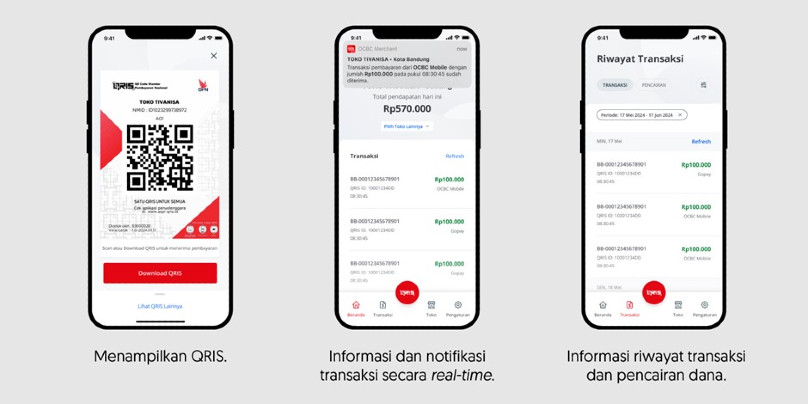

OCBC Merchant is an application designed to help business owners #DareToLevelUp, offering three main features:

Yenny Tandias, Merchant Solution Head at OCBC, said, “We understand that business owners today not only need convenience in receiving payments, but also require transparency, speed, and control over their businesses. Through OCBC Merchant, we aim to deliver a relevant, user-friendly solution that empowers MSMEs to level up in the digital era.”

OCBC applies a Merchant Discount Rate (MDR) for QRIS in accordance with Bank Indonesia’s policy. For micro-businesses, the MDR is set at 0% for transactions below IDR 500,000, and 0.3% for transactions above IDR 500,000. Meanwhile, for regular merchants, the MDR is set at 0.7%, for education at 0.6%, for fuel stations (SPBU) at 0.4%, and 0% for merchants related to social assistance and donations. These provisions are expected to provide ease and convenience for business owners in conducting efficient and affordable digital transactions.

To introduce OCBC Merchant to a wider audience, OCBC also participated in the annual DIGIWARA FESTIVAL (Karya Kreatif Banten) hosted by Bank Indonesia’s Banten Regional Office from 23–25 May 2025. This festival represents a real step in supporting MSME empowerment and digital transformation in the Banten region. At the event, OCBC actively provided education and raised awareness among visitors on the importance of digitalization and digital payment literacy.

Easy Onboarding for Business Owners

The OCBC Merchant application can be downloaded directly from the App Store and Play Store, making it an easily accessible solution for all business owners — whether they are OCBC customers or not. For non-customers, account opening can be done online through web.ocbc.id/daftarmerchant.

By using the OCBC Merchant application, business owners are not only enabled to accept QRIS digital payments easily, but also have the opportunity to earn 2,500 Poinseru, enjoy attractive discounts and cashback for every QRIS transaction. Additionally, they can participate in Nyala Bisnis Market, a bazaar event organized by OCBC as a platform for MSMEs to promote and sell their products directly to a broader market, while expanding their networks and business exposure.

OCBC also provides 24/7 customer support via TANYA OCBC (1500-999) and email at tanya@ocbc.id.

About OCBC

PT Bank OCBC NISP Tbk (OCBC) was established in Bandung in 1941 under the name Nederlandsch Indische Spaar en Deposito Bank. Over its 84 years of journey, the Bank has undergone several name changes, from 'Bank NISP' to 'Bank OCBC NISP', and 'OCBC' on November 14, 2023. As of March 31, 2025, OCBC serves customers through 205 office networks in 54 cities in Indonesia. Furthermore, customers could conduct transaction through the Bank's 529 ATM, more than 90,000 ATM networks in Indonesia, and connected to more than 580 OCBC Group ATM networks in Singapore and Malaysia. OCBC also serves customers through various digital channels, including mobile banking and internet banking – both for individuals and corporations. OCBC is one of the banks with the highest credit ratings in Indonesia, namely AAA(idn)/stable from PT Fitch Ratings Indonesia.

Brand & Communication Division, OCBC

OCBC Tower, Jl Prof Dr Satrio Kav 25, Jakarta 12940

Tel: 021- 25533888; Fax: (62)-021-57944000

Email: brand.communication@ocbc.id

Website: www.ocbc.id

|

Aleta Hanafi Division Head aleta.hanafi@ocbc.id, Mobile: 62-8119860068 |

Chandra Novita Publicist chandra.novita@ocbc.id Mobile: 62-8111071069 |

|

Nadya Maharani Publicist nadya.maharani@ocbc.id Mobile: 62-8118725945 |

Novi Henriatika Publicist novi.henriatika@ocbc.id Mobile: 62-8119812329 |