The dip in the AUD can be explained by the shock of ‘risk up, (US) rates up’ of early January, followed by the equity volatility shock of late January and, more recently, the surprise easing by the Reserve Bank of Australia (RBA). However, the risk-friendly global backdrop, higher commodity prices and a domestic economic upswing now underway should support a stronger AUD. We see AUDUSD getting to 0.83 in a year’s time.

Despite the rocky start to the year, AUD’s high sensitivity to risk sentiment suggests that the currency should continue to benefit from global reflation optimism. For many investors, the premise for the reflation optimism is underpinned by the idea of a progressive vaccine rollout releasing pent-up consumer demand, coming US fiscal expansion, and a Federal Reserve that is apparently more than prepared to let the US economy run hot.

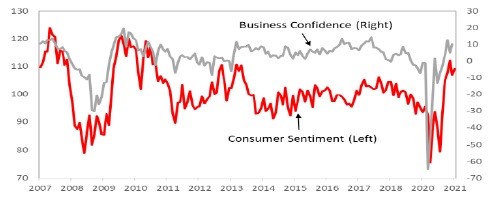

Rebounding consumer and business sentiment points to a stronger Australian economy

Source: NAB, WBC-MI, Bloomberg, Bank of Singapore

Australia’s adept handling of the Covid-19 crisis means that the country has been able to return to relative normality faster compared to most Western economies. Substantial government transfers have boosted household savings, which should allow consumer spending to ramp up further as restrictions ease and more services become available. A domestic upswing is underway and will be supported by a vaccine rollout from February. An indication of a stronger Australian economy comes from consumer and business sentiment, which has rebounded to a decade high.

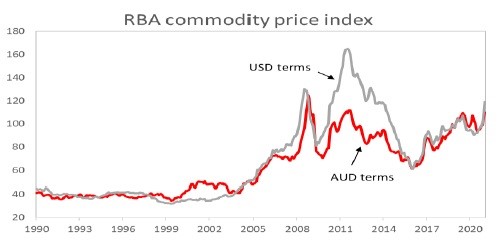

It is positive that Australia has commodities to export and that production has not been disrupted by the pandemic. The level of commodity prices suggests more AUD upside. Sharply rising export commodity prices such as iron ore should provide sizeable support for the AUD. Rising commodities prices are not only supporting Australian growth but are also moving Australia away from structural current account deficit to surplus.

The level of commodity prices suggests more AUD upside

Source: Bloomberg, Bank of Singapore

Our base case is that Australia’s stronger external position will not be seriously undermined by: (1) geopolitical tensions between Australia and China and (2) China’s credit policy turning more neutral given the country’s strong V-shaped recovery. The slower pace of China’s total social financing (TSF) and M2 YoY growth in January was expected – and is both understandable and appropriate to China’s economic circumstance. Despite a peaking of China’s credit impulse, a catch-up in US commodity demand on prospects of higher infrastructure spending and the drive towards cleaner energy globally, which will benefit industrial metals, should continue to support commodity prices and the AUD.

We view the RBA’s surprise easing – by extending its Quantitative Easing program by a further AUD100 bn over six months -- as leaning against significant AUD upside, rather than trying to weaken it. We do not see this as a major headwind for the AUD.

This article was first published by Bank of Singapore on February 15, 2021. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.