Choose the Life Goals you want : education, retirement, religious tourism, traveling, marriage then simulate the need for funds according to the time period of saving

Buy and invest in the right product to achieve life goals

Monitor how close your funds are ready to life goals

Discuss your Life Goals planning with a Financial Advisor. Make an appointment here (web.ocbc.id/advisor).

Login to OCBC mobile application, then click Life Goals menu

Click Rencanakan Life Goals to start setting target and making life goals

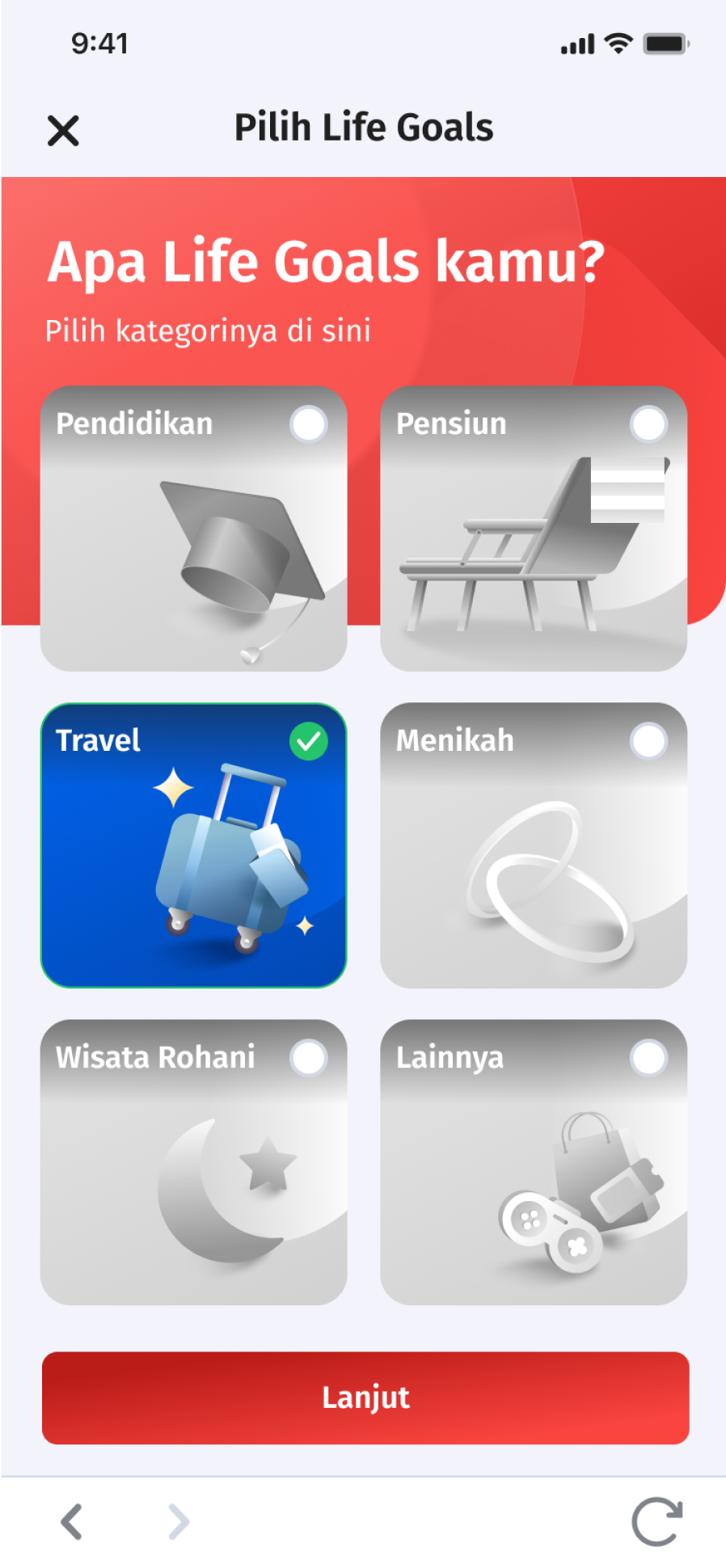

Select the Category Life Goals according to your needs and click continue

Complete the data according to the instructions then click Continue

Check the summary of your Life Goals then click Save

Your life goals have been saved

Click Buy Investment Product

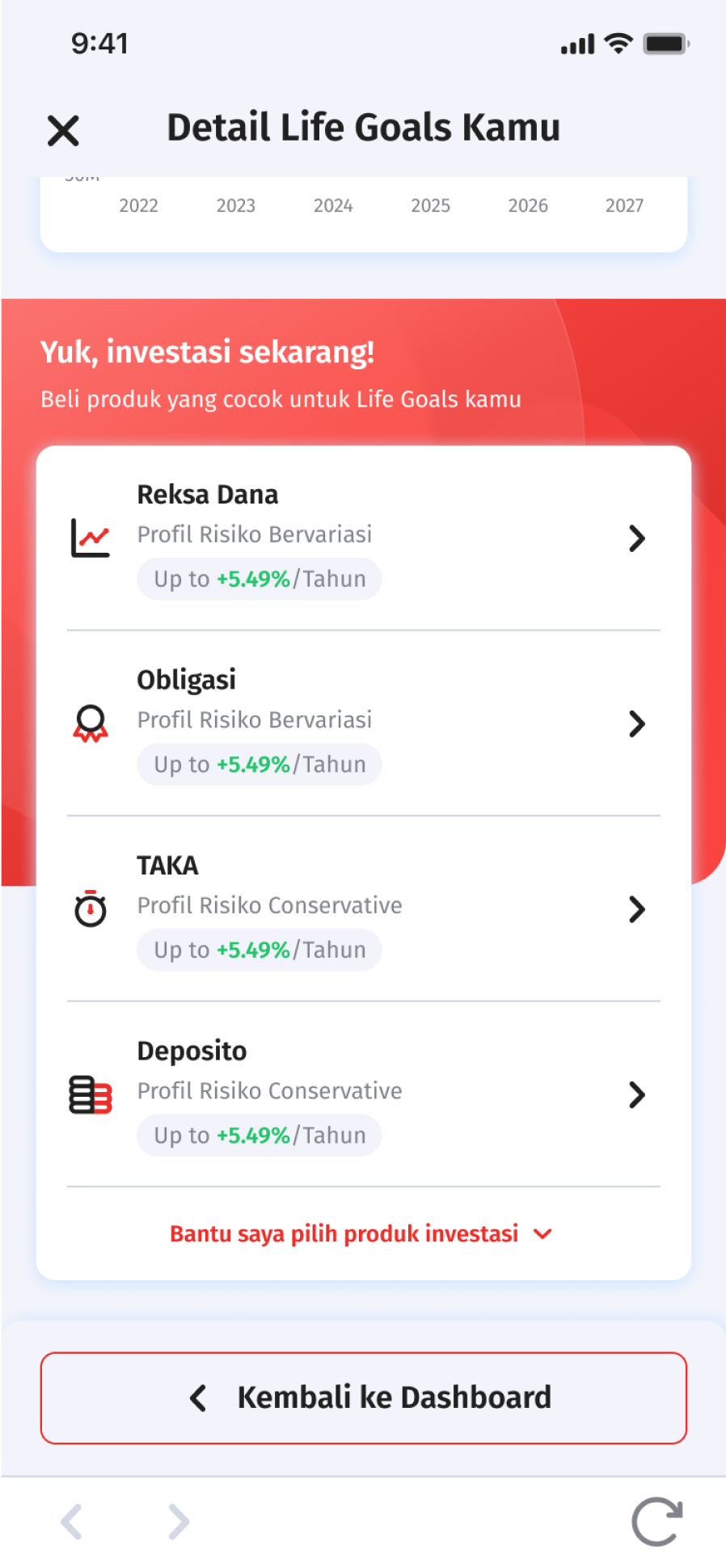

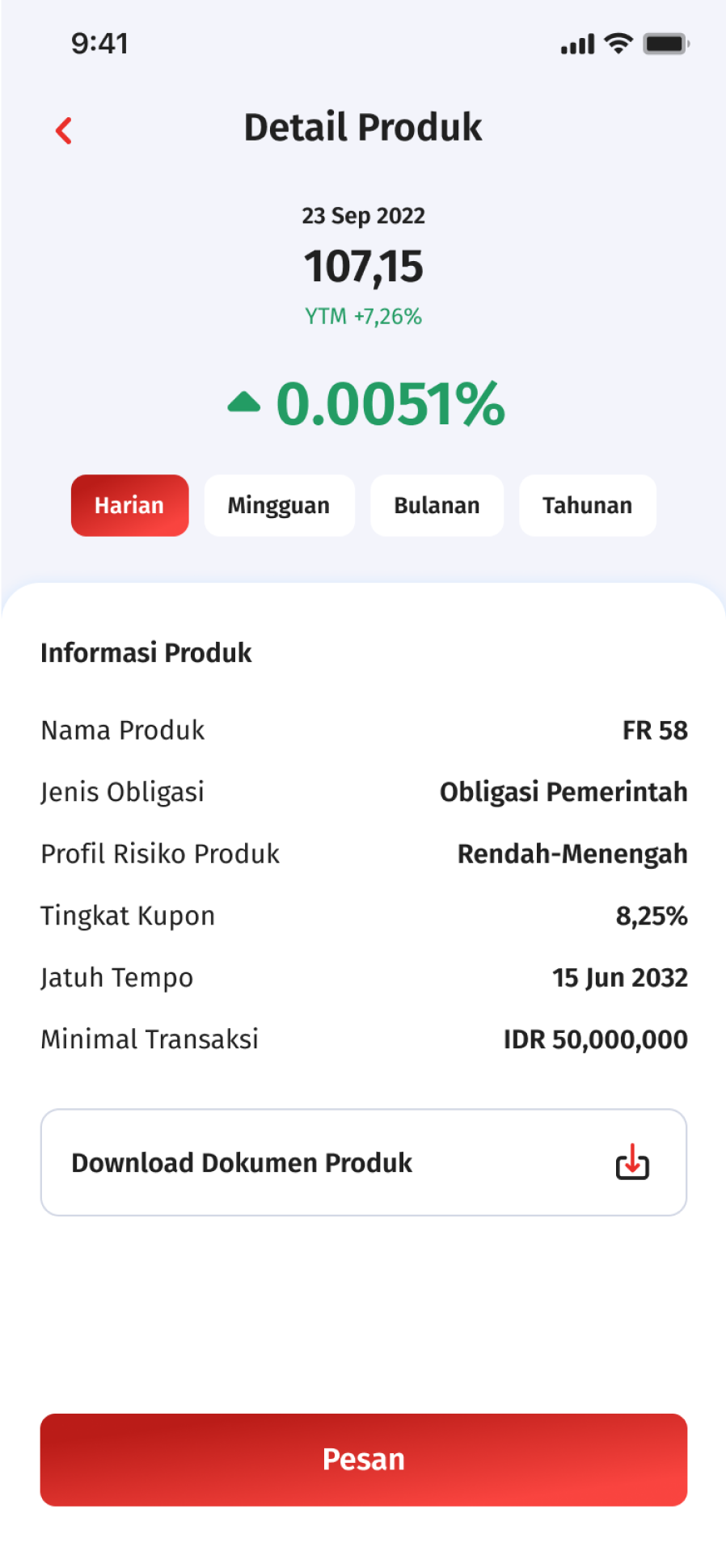

Choose investment products. If confused to choose the right product click “Help Me Choose”

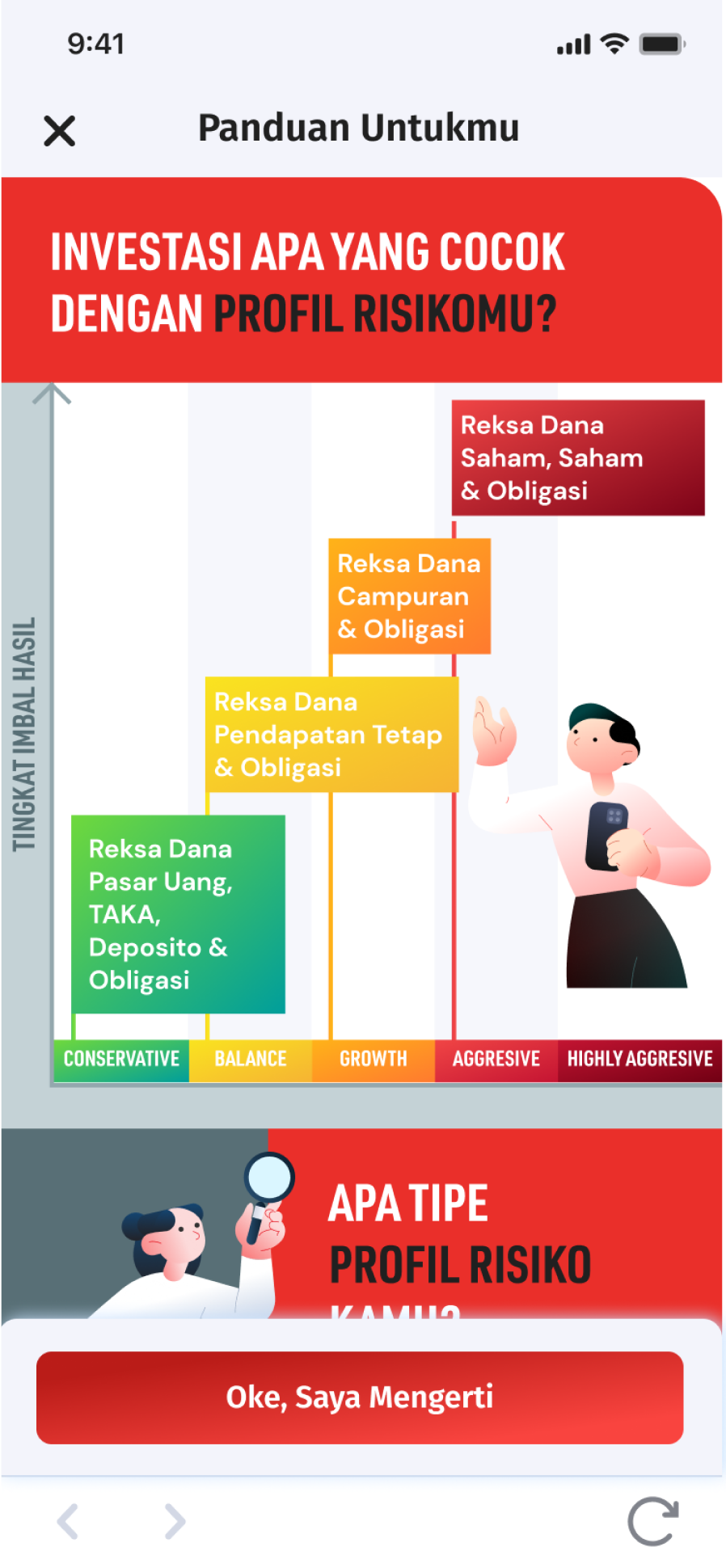

Read the product guide, click “Ok, I Understand” and choose an investment product that matches with your life goals

Click Order and Continue

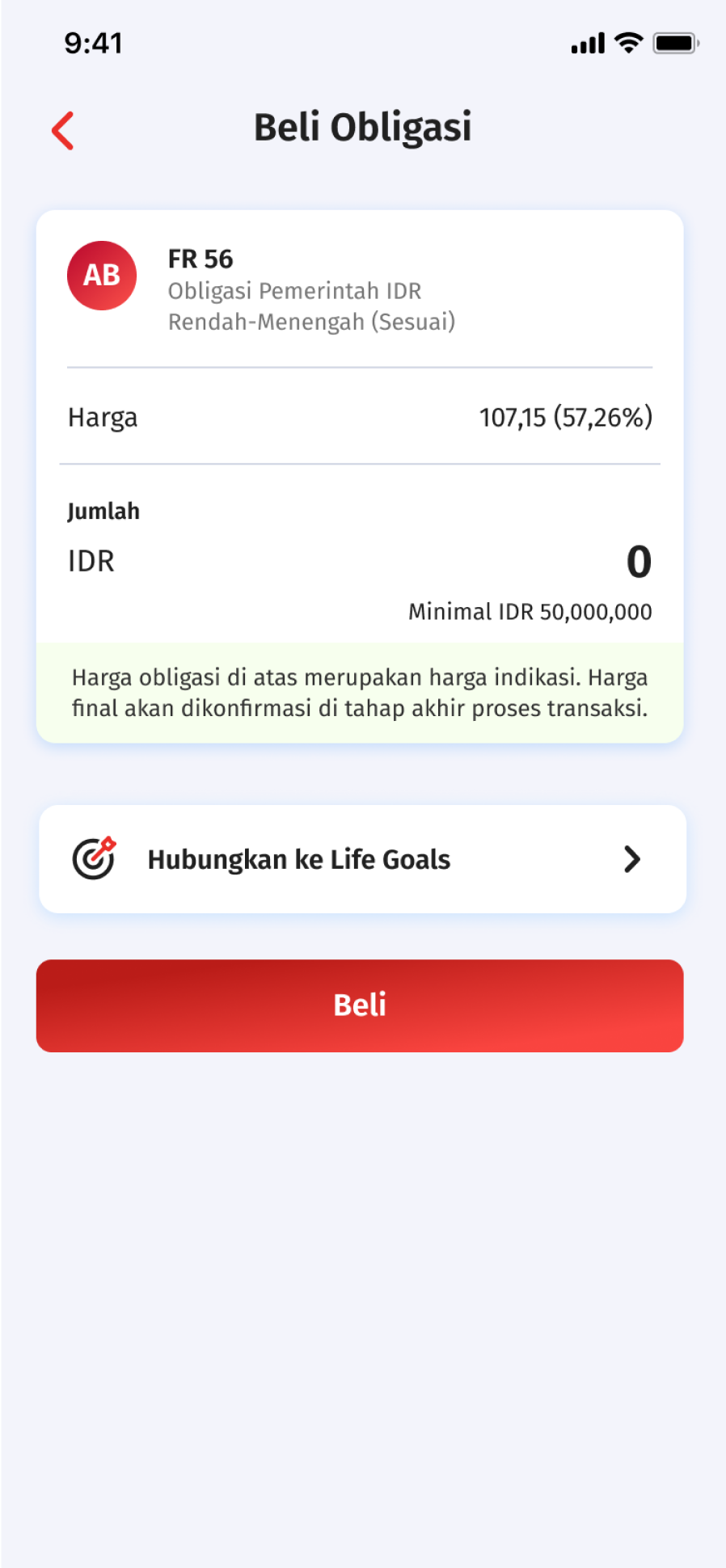

Click Link to Life Goals, then click one of Life Goals that you want to link

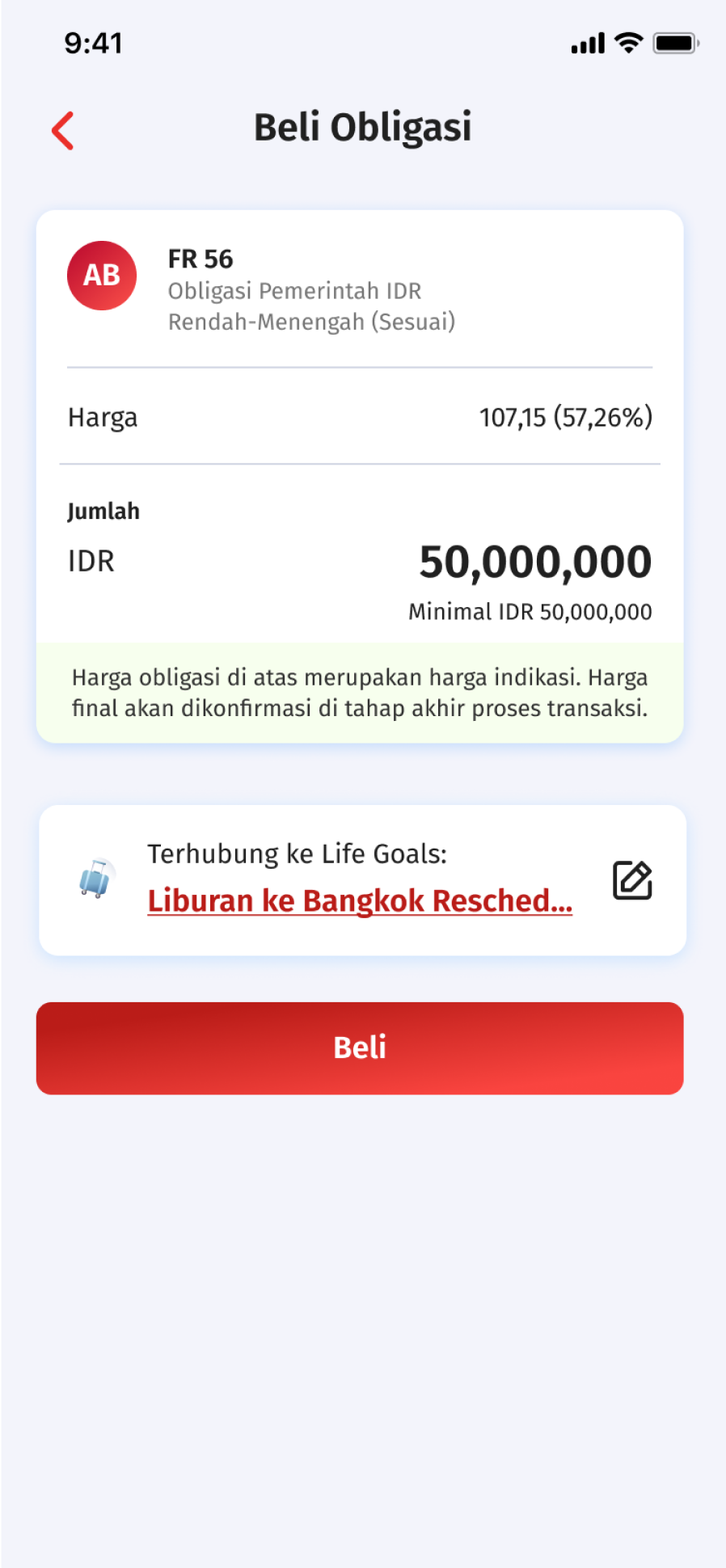

Life Goals successfully linked and click Buy and continue the transaction until finish

See and monitor the accumulation of all Life Goals, click on one of the Life Goals to see more details

Then the details of one of your life goals appear

To edit, delete or share your Life Goals, click the three dots in the upper right corner

Frequently Asked Questions about Life Goals

B: Life Goals is OCBC mobile’s feature which helps you to manage way of saving become easier. You can create Life Goals according to your needs and connect your investment products to meet your target funds.

B: With Life Goals, you can be more disciplined in investing thus your investment goals or long-term goals in your life will be more focused and can be realized through Life Goals feature which monitored and customized.

B: Step to Create Life Goals:

B: You can choose these categories: Pension Fund, Education, Travel, Marriage, Religious Tourism & many more.

B: You can choose ‘Others’ category and filled the Life Goals data accordance to your needs such as business capital, medical expenses, and more.

B: No, I am free to input any nominal here according to the funds that I have been prepared—not necessarily according to the value of the assets owned in OCBC mobile.

The example of filling funds that I Have Prepared’:

B: No, achievement in Life Goals shown on the goal tracker, will only updated according to the nominal entered in the ‘Funds you have prepared’ and according to the value of the investment product that has been linked to Life Goals.

Display goal tracker in Life Goals details:

B: Goal tracker is an indicator of the achievement of your Life Goals that shows:

B: Currently, Life Goals can only be linked to products Reguler Saving Plans, Deposit, Mutual Funds and Bond.

B: No, 1 (one) product can only be linked to 1 (one) Life Goals.

B: You can link or unlink investment product in Life Goals. You can set the investment product that you want to link your Life Goals, via the product page on OCBC mobile, via banner or slider on the Life Goals detail page.

Link product via OCBC mobile:

Link product on Life Goals detail banner:

or on Life Goals detail slider:

B: Yes, if there is a deposit product that is due date or withdraw before the date, the goal tracker will be reduced according to the amount returned to savings.

B: Currently there is a banner under the goal tracker in the Life Goals detail that inform you:

Banner A:

Banner B:

)

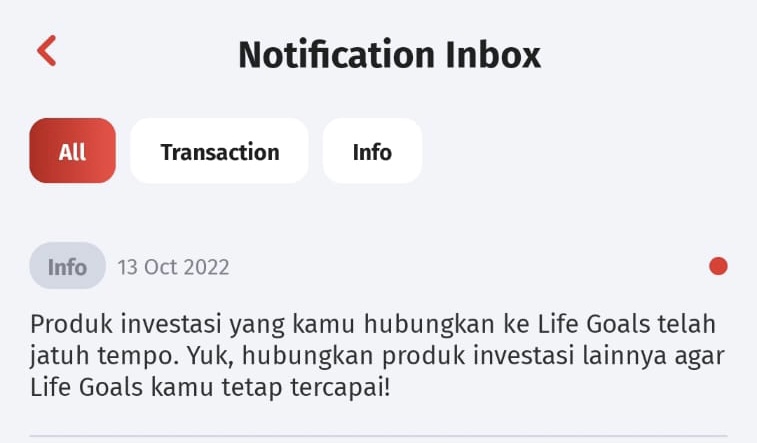

B: Your will get notification if there is a product Reguler Saving Plans or Deposit linked to your Life Goals but is due date, so the product will automatically be disconnected from your Life Goals while reducing the calculation in the goal tracker.

Notification display for Reguler Saving Plans when due date:

B: Currently, Life Goals cannot be shared with others. You can only link your own investment product to the Life Goals you have created.

B: The goal tracker data on the chart will be updated every time you open the Life Goals detail.

B: The target fund is adjusted to the inflation assumption from data of the latest 10 years, and the estimated performance of investment products.

B: Factor for calculating Life Goals:

Can't find the question you're looking for?

View Other Questions