To the extent that there have been big trends in 2025, they have been in gold alongside the rally in Chinese technology and European defence stocks. Little has changed to our positive gold view except that the gold rally has been much sharper than expected. Gold hit a record high of USD3,167/oz on 3 April 2025 following President Trump’s unexpectedly severe reciprocal tariff announcements.

We continue to think gold prices have not yet peaked. We raise our 12-month gold price forecast to USD3,400/oz from USD3,100/oz. Stagflation risk fuelled by trade uncertainty and concerns over an erosion of the USD’s global financing and reserve role in a Trump 2.0 world remain potent tailwinds for gold.

The recent uptrend in gold ETFs has plenty of room to extend

Source: Bloomberg, Bank of Singapore.

Since mid-2024, gold Exchange Traded Fund (ETF) outflows have reversed, marking a shift in trend from recent years. Despite gold ETF inflows gaining momentum, total holdings globally remain well below the record highs reached five years ago, suggesting there is ample room for this trend to extend. Investors could continue to buy gold as a portfolio hedge against stagflation risk as uncertainty related to tariff policies are likely to remain elevated.

The Federal Reserve will need concrete data indicating a more material slowing of the US economy or inflation cooling to feel comfortable easing. However, the market has moved in response to US growth concerns, with 10Y US Treasury (UST) real yields falling back below 2%, approaching their lowest levels since the US presidential election. Despite a noticeable shift in gold’s relationship with US 10Y real yields in 2022, we maintain that real yields would remain a dominant driver of gold as a zero-yielding asset.

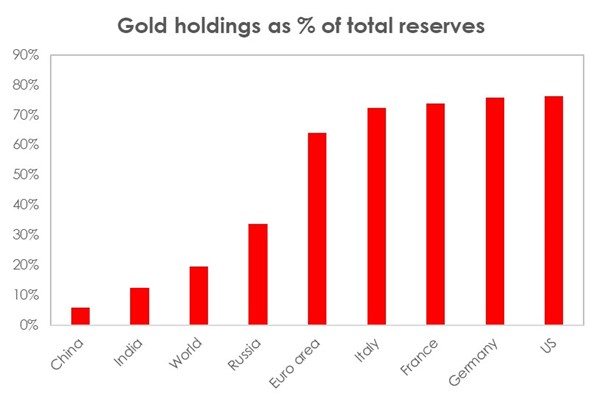

EM central banks remain underweight gold compared to their DM counterparts

Source: World Gold Council, IMF IFS, Bank of Singapore.

Emerging Markets (EM) central banks, which are underweight gold compared to their Developed Markets (DM) counterparts, are likely to remain strong buyers of gold. Diversification away from USD reserve holdings, while still moderate, could pick up on concerns over an erosion of the USD’s global financing and reserve role in a Trump 2.0 world. The underpinnings of the USD’s global role could potentially weaken as Trump’s policies prompts the world to increasingly question whether the US is a reliable partner.

Silver is likely to benefit as a catch-up play as investors look for alternative ways to capitalise on the bullish gold trade. But silver has yet to outperform gold in a rising gold price environment, which has typically been the norm. A key factor behind silver’s underperformance is the concern that stagflationary risk may negatively impact its industrial demand.

This article was first published by Bank of Singapore on 3 April, 2025. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of OCBC Private Bank or its affiliates.

OCBC Private Bank provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC Private Bank is a part of OCBC Group.