Join FTL membership start from 6 months to get cashback up to IDR1,25 mio.

Minimum transaction of IDR250,000, can be converted to 3 months instalment via OCBC mobile

Get 1 Poinseru from every IDR10,000 transaction and redeem it to get your wishlist gift!

Now you can make credit card

transactions without your

physical card. Simply just tap

your credit card via

OCBC mobile to enjoy seamless & worry-free transactions.

Info: web.ocbc.id/tapkartukredit

Enjoy discount or free 12 months instalment at our selected merchants.

Info www.ocbc.id/id/promo

Every transaction of IDR 10,000 with a OCBC FTL Platinum Credit Card gets 1 Poinseru which can be exchanged for various a

exciting rewards. Poinseru

redemption can be done easily

on OCBC mobile.

Now you can withdraw the remaining credit card limit directly

into your savings account with

interest up to 0% via

OCBC mobile.

Info: web.ocbc.id/cairlimitcc

With the Contactless feature,

valid in countries and

transportation companies that

accept payments by Credit Card and contactless

Equipped with contactless

features for convenience,

security & faster transaction

Shopping at various merchants

and Visa partners

Free cash withdrawals anytime

at more than 1 million ATMs

worldwide

Payment of credit card bills of at least 5% of the total bill

Pay bills through ATMs, Internet Banking, Cash Deposits & others

Ready to serve customer for

OCBC Platinum Credit Card

information

Exchange Poinseru through

OCBC mobile

Now traveling abroad is easier

because you can transact on

Alipay & Weixin Pay with OCBC

Credit Card. Info: web.ocbc.id/trxchina

Special Offers in Indonesia,

Singapura, & Malaysia

Related information about OCBC FTL Platinum

Apply OCBC FTL Platinum Credit Card and Join FTL membership, Get higher reward cashback

| Membership Package | Reward cashback with OCBC FTL Platinum* Credit Card |

|---|---|

| 6 Months FTL Pilates+ Membership | Cashback IDR450.000 |

| 6 Months FTL Ultra Gym Membership | Cashback IDR400.000 |

| 12 Months FTL Pilates+ Membership | Cashback IDR1.000.000 |

| 12 Months FTL Ultra Gym Membership | Cashback IDR400.000 |

| 1 Month FTL Ultra Gym Membership |

|

Terms and Conditions :

| Promo | Reward |

|---|---|

| Open an OCBC account with the promo code OCBCxFTL - Deposit IDR 10,000,000 and make a transaction at FTL using an OCBC debit card/QRIS from your OCBCxFTL account. | Cashback IDR250.000 |

Terms & Condition:

Installment Conversion is a term credit facility for your credit card spending transactions ranging from 3 to 36 months with easy installment. The interest rate in the Installment Conversion is determined by Bank OCBC and may change at any time with prior notice. The period of installment is set by the Card Holder itself and cannot be changed again. The Card Holder can enroll the Installment Conversion by sending SMS from mobile phone number that registered on credit card system and later the Card Holder will get the confirmation.

SMS to 86477

The format of the SMS change transactions into installments as follows:

OCBC[space]CICIL[space]The Last 16 Digits of Credit Card number#Total Transaction#Tenor

Example: OCBC CICIL 5241690000001234#30000000#12

OCBC Platinum is accepted worldwide with more than 29 Millions merchants and service partners that collaborate with VISA international.

Apart from being able to do fund withdrawal in all OCBC Branches, OCBC Platinum credit card can also be used for fund withdrawal in more than 1 Million ATMs worldwide, 24 hours a day and 7 days a week. You can withdraw up to 70% of your OCBC Platinum credit card limit.

Your OCBC Credit Card can be used to pay recurring utilities payment such as TELKOM, PLN, PAM, TV Subscription, IPL (building maintenance fee), and Insurance by:

OCBC Bill

Register your recurring bill for service providers in agreement with OCBC by contacting Tanya OCBC 1500999 or your Relationship Manager. More information, click here

OCBC ATM

Visit the nearest OCBC ATM and choose “Payment / Purchase / Cash Advance” menu using your credit card PIN. If you do not have your PIN yet, please create your PIN immediately. More info visit www.ocbc.id/pin

Your OCBC credit card payment can be done by paying the minimum 5% of the total bill or IDR 50,000 (whichever is higher).

You can pay your bill by various methods :

We are ready to serve you 24 hours a day 7 days a week to get information about OCBC Platinum credit card at 1500-999.

Interest and Fees

| Annual fee (free of the first year fee) | Main Card IDR 600,000 per year, Supplementary Card IDR300,000 per year |

| Retail Interest | 1.75% per month, 21% per year |

| Cash Advance Interest | 1.75% per month, 21% per year |

| Minimum Payment | 5% of the bill or a minimum of IDR50,000 (Until 30 June 2026 or always binding with Bank Indonesia regulations) |

| Cash Advance Fee | 6% or a minimum of IDR 100,000 (whichever is greater) |

| Late Payment Fee (Late Charge) | 1% of the total bill, minimum IDR 50,000 and maximum IDR 100,000 (Until 30 June 2026 or always binding with Bank Indonesia regulations) |

| Over-limit Fee | 6% of the excess limit, a minimum of IDR 100,000 and a maximum of IDR 250,000 |

| Lost/Damage Card Replacement Fee | IDR200,000 |

| Billing Statement Delivery Charge | IDR30,000 per billing |

| Transaction Copy Request Fee | Transaction Note IDR 50,000 , Monthly Bill IDR 30,000, and Declined Check / Giro Fee IDR 25,000 |

| Duty Stamp Charged for Payments with Certain Amount | Payment amounted above IDR 5,000,000 will be charge Duty Stamp IDR 10,000 |

| Credit Card Payment Costs through Teller at OCBC Branch | IDR 10,000 |

| Installment Request Fee |

Through OCBC mobile Application, EDC and SMS IDR 25,000 per transaction Through Contact Center – Tanya OCBC IDR 25,000 per transaction |

| Installment Payment Cancellation/Acceleration Fee | IDR 200,000 per transaction |

| Transfer fee | IDR 10,000 to OCBC account IDR 25 thousand to another bank account |

|

E-Statement via Email Fee Request Increase Limit Fee Notification Charges |

IDR 5,000 per bill per month IDR 50,000 only applied if the request is approved IDR10,000 per bill per month |

| Important Information |

|

Interest Calculation for Shopping Transactions (Retail):

Interest will be charged if the Cardholder pays less than the total new bill, or pays after the Due Date. Interest for Shopping Transactions is calculated based on the Posting Date (Posting Date) of the transactions made. The interest rates that apply to purchase transactions are listed on the Billing Sheet. Unpaid costs, penalties, or interest are not included in the interest calculation component. Interest will be charged on the next billing sheet. For a complete interest calculation can be seen in the illustration of credit card interest calculations.

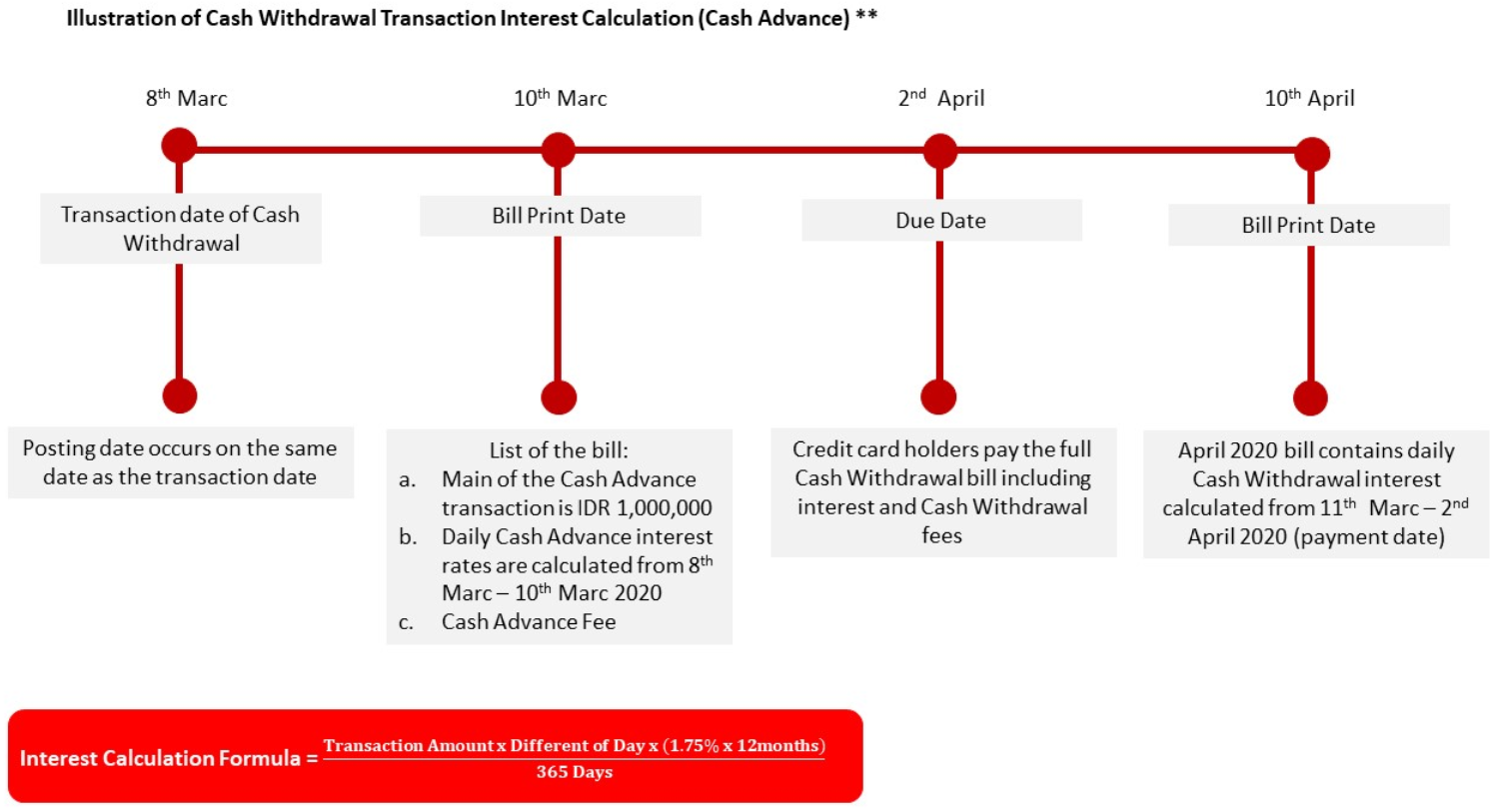

Interest Calculation for Cash Advance Transactions:

Interest for Cash Advance is charged and calculated from the Date of Cash Advance until the date of full payment of the Cash Advance transaction. The interest rates that apply to Cash Withdrawal transactions are listed on the Billing Sheet. Unpaid costs, penalties, or interest are not included in the interest calculation component. For a complete interest calculation can be seen in the illustration of the Credit Card Interest Calculation.

* This illustration uses the Platinum Credit Card due date

Note:

Illustration of interest calculation can give different results caused by:

The example of calculation of interest on Cash Advance transactions:

The Cash Advance transaction of IDR 1,000,000 is made and recorded on March 8, 2020. The Billing Statement print date is March 10, 2020. The Due Date is April 2, 2020.

The Cash Advance transaction interest that printed on the Billing Statement sheet for April 2020 is IDR 2,215 (*** see calculation method below).

Image of interest day calculation for Cash Advance transactions

** This illustration uses the calculation of the Titanium Credit Card due date

*** The interest calculation for the Cash Advance transaction was billed in April 2020 as follows:

Difference of days = (10 - 8) + 1 = 3, Interest = IDR 1,000,000 x 3 x (2,245% x 12 months) / 365 = IDR 2,215

The billing statement is a summary of transaction details of your OCBC Credit Card (from the previous month's billing date up until the subsequent billing date). Details of transactions printed are transactions made using the primary card and the supplementary card (if any). There is no separate billing statement for supplementary cards.

Primary Credit Card Number

This is OCBC Primary Credit Card number.

Statement Date

This is the date of transactions and other outstanding balances billing. It will fall on the same date each month.

Payment Due Date

The duedate for payment of outstanding balances that must be received by PT. Bank OCBC NISP, Tbk is 16 days for Platinum, Nyala Platinum, 90°N, Voyage Credit Cards and 23 days for Titanium Credit Cards from the billing date. Minimum payments must be paid each month on or before the due date even if you have not received a Billing Statement. Payments received after the due date will be subject to a late fee.

Current Month's Bill

This is the outstanding balance on the billing date which includes previous month's outstanding balance and transactions made up to the billing date, fees, interests and corrections deducting payments and credit.

Minimum Payment

The minimum payment is 5% of the outstanding balance or IDR 50,000 (whichever higher)*. If your outstanding balance exceeds your credit limit, such excess shall be added to the minimum payment which is about to become due. If you have not paid off the previous month's minimum payment, such amount shall also be added to your minimum payment which is about to become due. If there is any instalment transaction, it shall be billed in full.

*Until 30 June 2025 or always binding with Bank Indonesia regulations

Transaction Date

This is the date of the transactions of purchase, cash advance or other transactions made using OCBC Credit Card.

Posting Date

This is the date on which your transaction is posted or charged to your OCBC Credit Card account.

Transaction Description

This column contains information on the details of transaction made using your OCBC Credit Card:

Purchase

This is the total amount of purchase transactions of your OCBC Credit Card in the current month.

Administration Interests & Fees

This is the amount of interest (only if there is an interest expense) and administration fees charged.

Payment

This is the amount of payment of the OCBC Credit Card bill which you have made.

Total

This is the total amount of bill you have to pay in the current month.

Combined Limit

Total credit limit assigned to a cardholder through 1 or more credit card(s) owned. The total credit limit of your OCBC Credit Card constitutes the combination of credit limit of all credit cards you own. If you only have 1 card, the combined limit is equal to your Primary Card limit.

Remaining Combined Credit

This is the remaining amount of credit limit up until the billing date and can be used for transactions.

Current Month's Points (Platinum Credit Card only)

This is the total Reward Points you have earned in the current month.

Previous Total Points (Platinum Credit Card only)

This is the information on the previous month's Reward Points.

Redeemed Points (Platinum Credit Card only)

This is the information on the amount of Reward Points you have redeemed up until the current month.

Expiry Date (Platinum Credit Card only)

This is the expiry date of your Reward Points.

Total Points (Platinum Credit Card only)

This is your effective Reward Points.

Interest Rate (% of Retail Interest)

This is the information on the interest rate to be applied due to the customer's failure in making full payment of a bill. The rate is determined by the bank.

Interest Rate (% Cash Advance)

This is the information on the interest rate to be applied for cash advance transactions, the rate is determined by the Bank.

Note:

You will be charged the interest for:

Partner Merchants in Indonesia

Deal with special offers from Bank OCBC partner merchants in Indonesia

VISA Partner Merchants

Trade with special offers from VISA merchants all over the world

Partner Merchants in Singapore and Malaysia

Trade with special offers from VISA merchants in Singapore and Malaysia

OCBC mobile Application*

Download the latest version of OCBC mobile and follow the steps below:

Log in with your User ID and Password

Click "What You Owe"

Choose Card

Click "CREATE/CHANGE PIN"

Set your PIN and reconfirm

PIN successfully set

More information for OCBC mobile registration click here or Call OCBC 1500-999

Sending SMS to 6477**

SMS Format:

OCBC[space]SETPINCC[space]Last 4 Digit Credit Card#Date of Birth DDMMYYYY#Your 6 Digit PIN

For Example:

OCBC SETPINCC 1234#14121990#180825

(*Create PIN through OCBC mobile only for Basic Card Holder)

(**Create PIN through SMS for Basic and Supplement Card Holder using the registered telephone number on the Bank)

OCBC Credit Card is equipped with 3D Secure feature for the convenience and security of your online transactions. Make sure the mobile phone number you use is the same as the number registered in the Bank system.

Beware of fraud in the name of OCBC. OCBC never authorizes any party (including OCBC staff) to:

1. Take back your Credit Card for any reason.

2. Request confidential data such as User ID, PIN, Password, Passcode/OTP and CVV for any reason.

Frequently Asked Questions about OCBC FTL Platinum

| Terms | OCBC Platinum Credit Card |

|---|---|

| Age | Main Card Holders aged 21 - 65 years Additional Card Holders for a minimum of 17 years (Maximum 3 people |

| Citizenship | Indonesian citizen and foreign national |

| Income | Min Income: Rp. 36,000,000 per year. |

| Personal Identification Documents | Photocopy of KTP or Photocopy of Passport / KIMS / KITAS (For foreigners only) or Photocopy of Other Bank Credit Cards (For Other Bank Customers) |

| Income Document | Original month's latest salary slip / Statement of Income (Especially Employees and Foreigners) or Photocopy of SIUP / Company Establishment Deed Current account / savings account for the last 3 months (only for entrepreneurs) or Current Account / Savings Account for the last 3 months, Photocopy of Practice Permit and Photocopy of SPT (Professional Only). |

Every transaction of IDR 10,000 gets 1 Reward Point and applies multiples

Terms and Conditions for Exchange of OCBC Platinum Credit Card Reward Points through www.raih.id:

Points redemption for prizes are made directly through www.raih.id. Here are the steps to exchange your points:

For more information about the question and answer exchange question, please visit https://www.raih.id/static/faq

Main Card Rp. 600,000 per year, Supplementary Card: Rp. 300,000 per year (Free of first year tuition fees)

File an objection due to a transaction incompatibility, no later than 45 calendar days from the date the Billing Statement is sent. Please submit your objections to Call OCBC 1500-999 or + 62-21-26506300 (from abroad)

OCBC mobile Application *

Download the latest version of the OCBC mobile Application and follow these steps:

(* Create PIN via OCBC mobile only for Primary Card holders)"

Credit Cardholders can simply contact OCBC Tanya 1500-999 or + 62-21-26506300 (from overseas) for the process of blocking a lost Credit Card and submit a credit card replacement at a cost of IDR 200,000 for OCBC Nyala, 90N, Pet Lovers Platinum, Star Wars Platinum, Platinum and 1st Credit Cards and costs IDR 2,500,000 for an OCBC Voyage Credit Card.

The fee charged for the installment application is IDR25,000 per transaction

Can't find the question you're looking for?

View Other Questions

Jangan mudah percaya dengan panggilan telepon mengatasnamakan Bank hingga instansi Pemerintah!

Aktivitas digital yang semakin meningkat di dunia usaha turut mendorong munculnya berbagai modus kejahatan siber yang menargetkan nasabah. Salah satu pola yang kembali marak adalah dengan kedok pembatalan transaksi dengan nada mendesak atau penting, di mana pelaku menyamar sebagai pihak bank untuk memperoleh akses terhadap informasi perbankan Perusahaan Anda.

Seiring meningkatnya aktivitas digital, pelaku kejahatan siber terus mencari cara baru untuk menipu pengguna layanan perbankan. Salah satu risiko yang perlu diantisipasi sejak dini adalah beredarnya aplikasi palsu & link phishing yang dikirim dari pihak yang menyamar sebagai pihak resmi OCBC Business atau instansi lainnya.

Seiring meningkatnya aktivitas digital, pelaku kejahatan siber semakin sering memanfaatkan pesan (SMS/WhatsApp/E-mail) untuk mengirimkan tautan berupa link phishing / APK (Android Package Kit) yang disamarkan sebagai pembaruan data NIB (Nomor Induk Berusaha) atau NPWP Badan oleh instansi berwenang/pemerintah, atau modus lainnya seperti penawaran pembatalan transaksi yang mengatasnamakan Bank.

Kasus penipuan hingga akses perangkat pribadi dengan mengatasnamakan Direktorat Jenderal Pajak (DJP) terus terjadi dan dilakukan dengan cara yang berbeda-beda.