TOP UP BALANCE PROGRAM – IDR BONUS INTEREST RATE

NYALA Existing Customer Only

(Registered as OCBC Customers ≤ May 31st,2024)

IDR Bonus Interest Rate Program Terms & Conditions:

- Only applied for Nyala and Nyala Payroll customer services.

- IDR Bonus Interest Rate applied only for additional fund above the average balance of IDR savings in 1 (one) customers.

- Calculation of bonus interest rate based on growth in the average balance of conventional IDR Savings per month in 1 (one) CIF Customer

- Bonus Interest rate scheme according to tiering :

- Basis calculation (baseline) for average balance of savings in IDR currency in 1 (one) CIF Customer at May, 2024 (average balance: May 1st – 31st, 2024).

- Only applied for fresh funds in the total growth of funds.

- Savings balances that are taken into account are conventional savings in IDR currency and accounts in active status (for multicurrency accounts only IDR balances are taken into account). IDR Bonus Interest Program not applied for on-hold balance, TAKA IDR, RDN-IDR and Tanda Premium-IDR.

- Customer must have a Multicurrency Savings account* in active status, to get the bonus interest. If the customer has more than one Multicurrency Savings account*, one of them will be selected as the bonus interest crediting account.

- Tanda 360 Plus

- Tanda 360 Plus Digital

- Tanda 360 Plus Komunitas

- Program is only valid for IDR conventional savings excluding sharia savings/current accounts.

- Customers still get savings interest (counter rate) from the Savings account according to the applicable counter interest rate provisions.

- Customer does not get the bonus interest, if:

- The Customer quit from the Nyala & Nyala Payroll Service at the end of the current month, then the IDR Bonus Interest Rate program will not applied/ineligible.

- Customer does not have a Multicurrency Savings account* to credit bonus interest;

- Multicurrency Savings Account is not in active status.

- Bonus interest is credited maximum at the end of the following month (M+1).

Example: Mrs. Reni tops up funds and is eligible to get bonus interest on the average balance in June 2024. Then Mrs. Reni will get the bonus interest credited to her savings account maximum at the end of July 2024, etc. - Illustration of calculation to get the IDR Bonus Interest Rate:

- The Bank, based on its policy and discretion, has the right to suspend or cancel the provision of rewards if there are indications of fraud, irregularities or violations of these Terms and Conditions.

- The Bank has the right and authority to change, add and/or reduce these Terms and Conditions by notification through media deemed good by the Bank by taking into account the applicable laws and regulations.

- For more information, please visit the nearest branch or contact TANYA OCBC 1500-999.

IDR Bonus Interest Scheme

| Tier | Average balance growth* (IDR) | Bonus Interest Rate (% gross p.a.) |

|---|---|---|

| 0 | < 5 million | - |

| 1 | ≥ 5 million - < 25 million | 3,00% |

| 2 | ≥ 25 million - < 100 million | 4,00% |

| 3 | ≥ 100 million - ≤ 500 million | 5,00% |

*The maximum increase in average balance calculated for bonus interest is capped at IDR 500 million per customer.

*Multicurrency Savings Product Name:

TOP UP BALANCE PROGRAM - IDR BONUS INTEREST RATE

For NYALA New Customer - NTB/New to bank

(account opening starting June 1st, 2024)

IDR Bonus Interest Rate Program Terms & Conditions:

- Only applied for Nyala and Nyala Payroll customer services.

- IDR Bonus Interest applied only for additional fund above the average balance of IDR Savings in 1 (one) Customer's CIF.

- Calculation of bonus interest rate based on growth in the average balance of conventional IDR Savings per month in 1 (one) CIF Customer

- Bonus Interest scheme according to tiering:

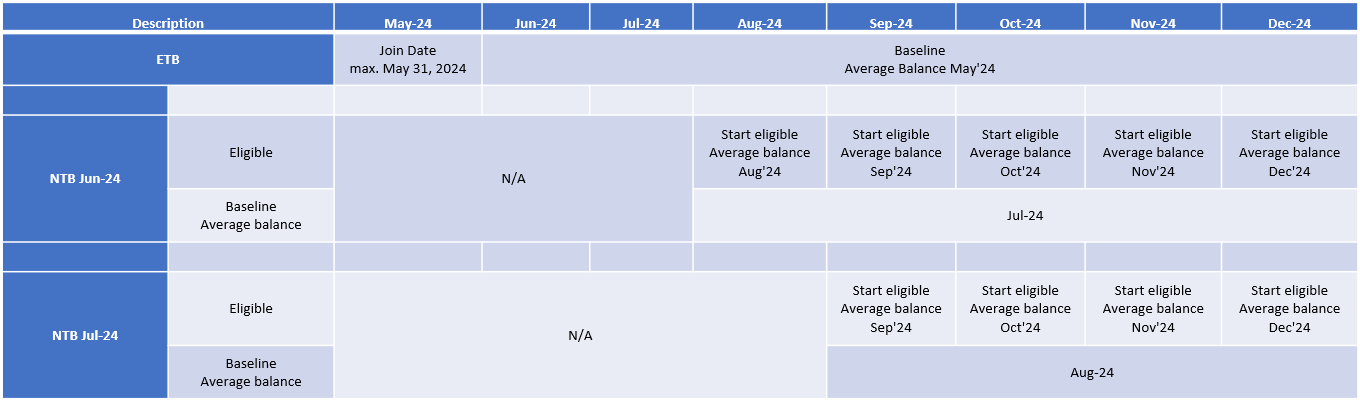

- Program applies to new Customer (M+2 months since joining as OCBC Customer)

- Basis calculation (baseline) for average balance of savings in IDR currency in 1 (one) CIF Customer at Month+1 (M+1) after customer join OCBC.

Illustration of the basic calculation (baseline) for new customers/NTB : - Only applied for fresh funds for the total growth of funds.

- Savings balances that are taken into account are conventional savings in IDR currency and accounts in active status (for multicurrency accounts only IDR balances are taken into account). IDR Bonus interest program not applied for on-hold balance, TAKA IDR, RDN-IDR and Tanda Premium-IDR.

- Customer must have a Multicurrency Savings account* in active status, to get the bonus interest. If the customer has more than one Multicurrency Savings account*, one of them will be selected as the bonus interest crediting account.

- Tanda 360 Plus

- Tanda 360 Plus Digital

- Tanda 360 Plus Komunitas

- Program is only valid for IDR conventional savings excluding sharia savings/current accounts.

- Customers still get savings interest (counter rate) from the Savings account according to the applicable counter interest rate provisions.

- Customer does not get the bonus interest, if:

- The Customer quit from the Nyala & Nyala Payroll Service at the end of the current month, then the IDR Bonus Interest Rate program will not applied/ineligible.

- Customer does not have a Multicurrency Savings account* to credit bonus interest;

- Multicurrency Savings Account is not in active status.

- Bonus interest is credited maximum at the end of the following month (M+1).

Example : Mrs. Reni is a new customer (NTB) in June 2024. Mrs. Reni tops up funds and eligible to get bonus interest on the average balance in August 2024. Then Mrs. Reni wil get the bonus interest credited to her savings account maximum at the end of September 2024, etc. - Illustration of calculation to get the IDR Bonus Interest Rate:

- The Bank, based on its policy and discretion, has the right to suspend or cancel the provision of rewards if there are indications of fraud, irregularities or violations of these Terms and Conditions.

- The Bank has the right and authority to change, add and/or reduce these Terms and Conditions by notification through media deemed good by the Bank by taking into account the applicable laws and regulations.

- For more information, please visit the nearest branch or contact TANYA OCBC 1500-999.

IDR Bonus Interest Scheme

| Tier | Average Balance Growth* (IDR) | Bonus Interest rate (% gross p.a.) |

|---|---|---|

| 0 | < 5 million | - |

| 1 | ≥ 5 million - < 25 million | 3,00% |

| 2 | ≥ 25 million - < 100 million | 4,00% |

| 3 | ≥ 100 million - ≤ 500 million | 5,00% |

*The maximum increase in the average balance calculated for bonus interest is capped at IDR 500 million per Customer.

*Multicurrency Savings Product Name: