Overnight, the European Central Bank kept its deposit rate at -0.50% while increasing its options to deal with the risks of higher inflation and weaker growth from the war in Ukraine.

Overnight, the European Central Bank (ECB) kept its deposit rate unchanged at -0.50% - in line with expectations - while increasing its options to deal with the risks of higher inflation and weaker growth caused by Russia’s invasion of Ukraine.

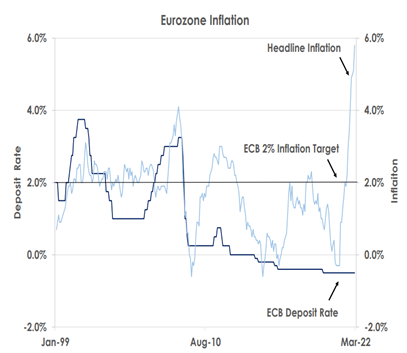

First, to counter inflation, the ECB confirmed its pandemic quantitative easing (QE) will finish this month and its remaining bond buying will be tapered faster to end by September at the latest. The first chart shows inflation has already hit 5.8% in February as Europe rebounded strongly from the pandemic last year, and the ECB forecasts inflation will still be above 5.0% at the end of this year because of the war’s shock to oil prices.

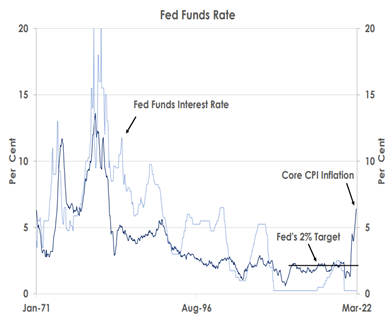

Second, to counter the threat of growth slowing sharply this year due to very high energy prices, the ECB kept its guidance that it will only start increasing interest rates once its QE is over. But the central bank said the start of its rate hikes could now be ‘some time after’ its bond buying finishes rather than its previous commitment to raise interest rates ‘shortly after the end’ of its QE.The ECB’s uncertain outlook is unsurprising given the unpredictable war in Eastern Europe. But we expect the EUR will weaken as a result against the USD and see the single currency falling to 1.05 over the next three months now. The ECB forecast the Eurozone will expand by 3.7% this year. But its estimate looks too high given the Ukraine crisis. We recently downgraded our forecast for Eurozone GDP growth from 4.2% to 3.2% in 2022. We thus expect the region to slow more sharply now from its strong, re-opening driven 5.2% growth from last year. We therefore see the ECB lifting its -0.50% deposit rate only from December at the earliest.In contrast, we expect the Federal Reserve will start hiking this month and raise its fed funds rate in five 25bps steps from 0.00-0.25% to 1.25-1.50% this year. Overnight, February’s US consumer price index (CPI) showed headline inflation hit a new 40 year high of 7.9% while core inflation reached 6.4% as the second chart shows. We see steady Fed hikes and safe-haven inflows to firmly support the USD while the Ukraine war continues.

This article was first published by Bank of Singapore on Mar 11, 2022. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.