- This year US growth has been resilient despite the Federal Reserve lifting interest rates to 5.25-5.50% to curb inflation. However, next year the economy is set to slow sharply, letting the Fed pivot to rate cuts.

- In 2023, large budget deficits, tight labour markets and excess savings from the pandemic have helped activity. However, unemployment, less fiscal stimulus and falling savings will hurt growth in 2024.

- For example, US consumers have been running down excess savings in 2023 built up during 2020-2021. As savings dwindle, consumption will slow.

- We forecast the US will suffer a mild recession next year. However, with core inflation also set to fall below 3%, we think the Fed will cut rates each quarter from June onwards to the benefit of risk assets.

This year US growth has been resilient despite the Federal Reserve lifting interest rates to 5.25-5.50% to curb inflation.

But next year America’s economy is set to slow sharply, letting the Fed pivot from rate hikes to cuts.

Source: Bank of Singapore, Bloomberg

In 2023, growth has been supported by several sources. The US budget deficit has surged from under 4% of GDP in 2022 to over 8% this year as the Biden administration has lifted spending sharply on infrastructure, semiconductors and renewables.

At the same time, unemployment has stayed below 4% as firms have retained employees after struggling to hire during the pandemic.

Last, consumers have been buoyed by large excess savings built up during 2020-2021 when the federal government provided stimulus cheques during the two years of lockdowns.

Source: Bank of Singapore, Bloomberg

In 2024, however, this year’s tailwinds are likely to abate. The Republican House of Representatives will not authorize fresh spending by the Democrat government, causing the budget deficit to start falling in 2024.

Unemployment is also rising as firms cut jobs as the US economy slows, and consumer spending is set to ease as excess savings built up during the pandemic continue to be run down now.

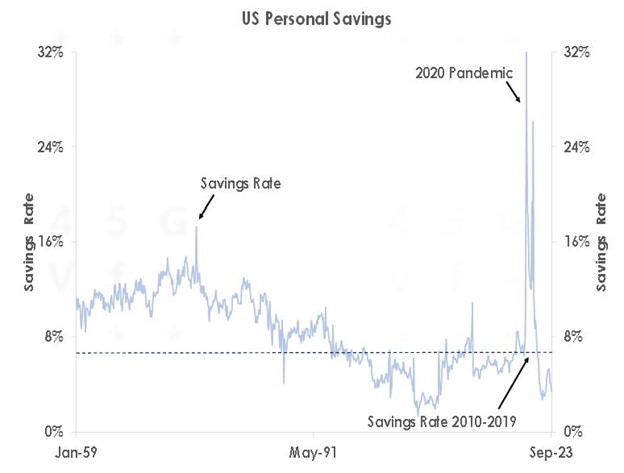

The first chart shows in 2020 and 2021, savings as a proportion of disposable personal income rocketed to as high as 32% compared to an average rate of 6.2% in the decade after the 2008 financial crisis.

But since the US fully reopened in 2022 and 2023, the savings rate has plunged well below pre-pandemic levels as consumers run down their excess savings.

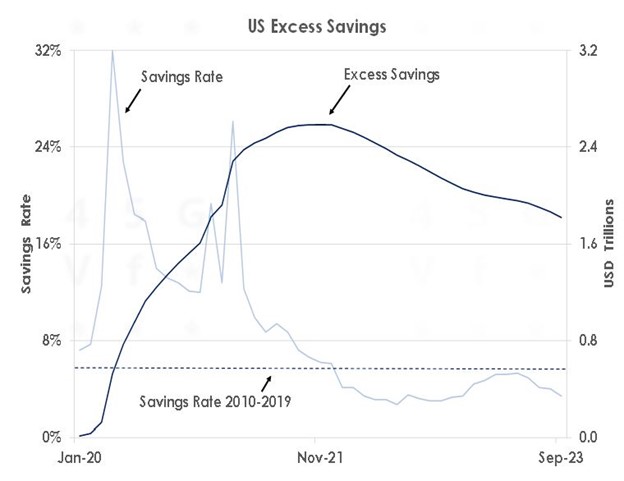

The second chart shows excess savings peaked at the end of 2021 around USD2.5 trillion and now have fallen to USD1.8 trillion.

As excess savings dwindle in 2024, consumers are likely to rein in their spending.

Less fiscal stimulus, rising unemployment and falling savings are all set to hurt economic activity in 2024.

We forecast the US will likely suffer a mild recession next year.

But with core inflation also set to fall below 3% towards its 2% target, we think the Fed will start lowering its fed funds rate each quarter with 25bps cuts in June, September and, after November’s elections, in December.

The Fed’s easing will be measured but will benefit risk assets.

Forward-looking financial markets are thus rallying now in anticipation of the Fed pivoting to rate cuts in 2024.

This article was first published by Bank of Singapore on November 29, 2023. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of OCBC Private Bank or its affiliates.

OCBC Private Bank provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC Private Bank is a part of OCBC Group.