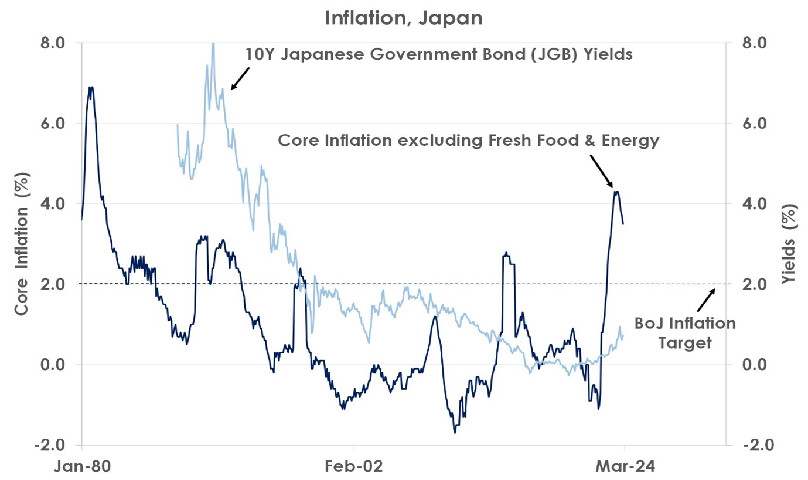

- January’s consumer price index (CPI) was firmer than anticipated with inflation staying above the Bank of Japan’s 2% target at 2.2% and core inflation excluding fresh food and energy at 3.5%.

- The data supports our view that inflation will at last settle around the BoJ’s 2% goal after three ‘lost decades’ with sticky services prices rising annually by 2% or more for the last six months now.

- We thus expect the BoJ will tighten monetary policy in response to the firmer inflation outlook by abolishing its cap on 10Y bond yields and by ending negative interest rates at its April meeting.

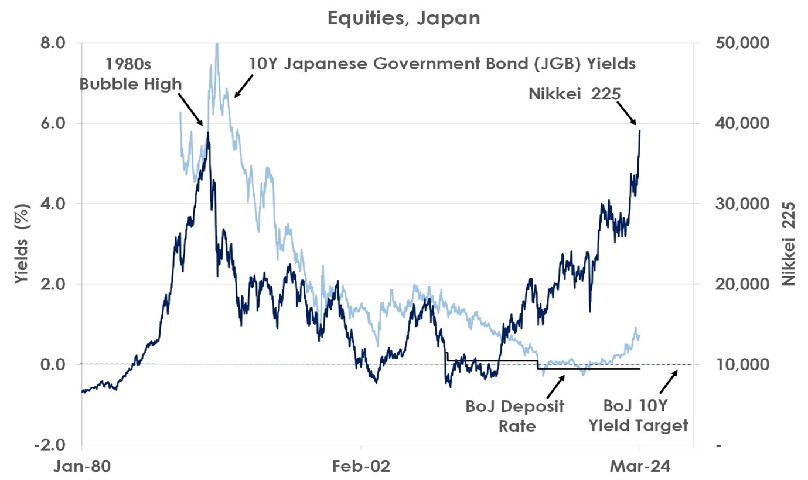

- Tighter BoJ policy will help the JPY but dovish officials will keep supporting equities this year by refraining from further rate hikes beyond April.

January’s consumer price index (CPI) report was firmer than anticipated. Headline inflation fell from 2.6% to 2.2% but stayed above the Bank of Japan’s 2% target while core inflation - excluding fresh food and energy - only dipped from 3.7% to 3.5%. Thus, core inflation remains close to four-decade highs as the chart below shows.

Source: Bank of Singapore, Bloomberg

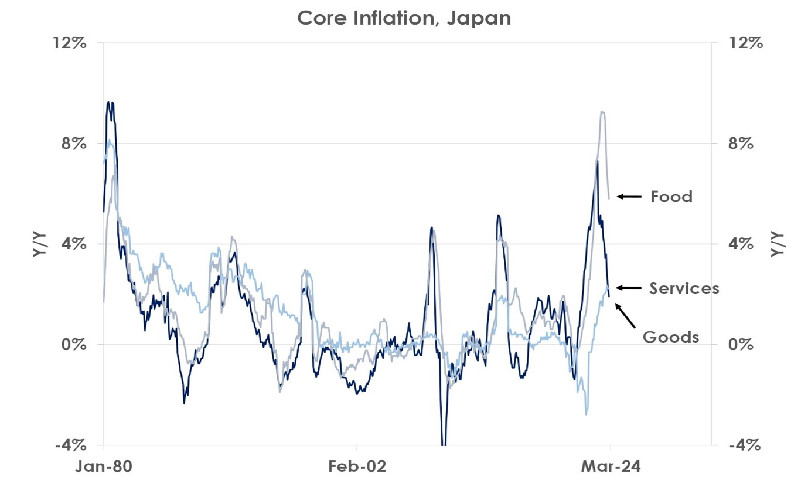

The data supports our view that inflation will at last settle around the BoJ’s 2% goal after three ‘lost decades’ of deflation and weak growth. January’s CPI report showed the shocks of the pandemic and the war in Ukraine are easing with goods and food prices (excluding fresh food) both falling 0.1% last month. But stickier services prices rose 0.4% as tighter labour markets after the pandemic forced firms to pass on higher wage costs to their customers.

Source: Bank of Singapore, Bloomberg

The second chart shows services inflation has been running at 2% or more for the last six months. Thus, even while food and goods prices receded after the pandemic, overall CPI inflation appears likely to settle around the BoJ’s 2% target, underpinned by rising services prices.

Source: Bank of Singapore, Bloomberg

We expect the BoJ will tighten monetary policy in response by abolishing its cap on 10Y bond yields and by ending negative interest rates in April. By then Japan’s spring wage round is likely to show salaries rising firmly for a second year. Tighter policy will help the JPY but the BoJ is unlikely to derail the record rally in Japan’s equities shown in the last chart. Instead, we think dovish officials will keep the BoJ’s deposit rate at 0.00% for the rest of 2024 after raising it from -0.10% in April to ensure inflation becomes entrenched around the BoJ’s 2% target.

This article was first published by Bank of Singapore on February 28, 2024. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of OCBC Private Bank or its affiliates.

OCBC Private Bank provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC Private Bank is a part of OCBC Group.